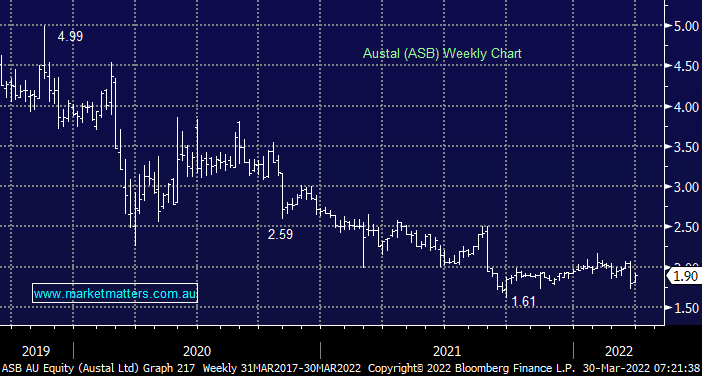

Shares in the shipbuilder fell during the week after it was announced it had been overlooked for a key Philippines Navy contract despite having a MoU in place on the deal. There are a number of other contract negotiations ongoing which we’re hopeful will end more favourably as Austal looks to replenish its order book. Yesterday, though, Twiggy Forest’s investment vehicle Tattarang announced it had acquired an 8% interest in Austal, including a 4.9% equity swap deal. Tattarang has been involved in a number of takeovers and strategic investments over recent years, including buying the famous R.M. Williams brand in 2020. The end goal may be a takeover, but Tattarang will at the very least keep the Austal team honest.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM remains bullish and long ASB

Add To Hit List

Related Q&A

Q&A for Sat Weekend report – ASB & XRO

Thoughts towards Austal (ASB)

Thoughts on ASB after its downgrade?

Thoughts on Capitol Health, Austal and Standline Resources?

Austal (ASB) – is it a buy?

Is Austal a takeover target?

Austal (ASB) share price decline

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.