ALX is a global toll road operator managing a portfolio of high-quality toll road assets, including APRR (Autoroutes Paris-Rhin-Rhône), Dulles Greenway, and Chicago Skyway in the US. The stocks endured a tough 2024, falling over 20%, representing a “yield trap” in the process. Losses have significantly outstripped its 40c unfranked dividend. A couple of the headwinds facing ALX should improve moving forward:

- Debt Concerns: Investors have expressed concerns about Atlas Arteria’s high debt levels, but as rates fall, pressure will ease.

- Slowing Traffic Recovery: While traffic volumes on its toll roads are recovering, particularly in France (its largest market), the pace has been slower than expected.

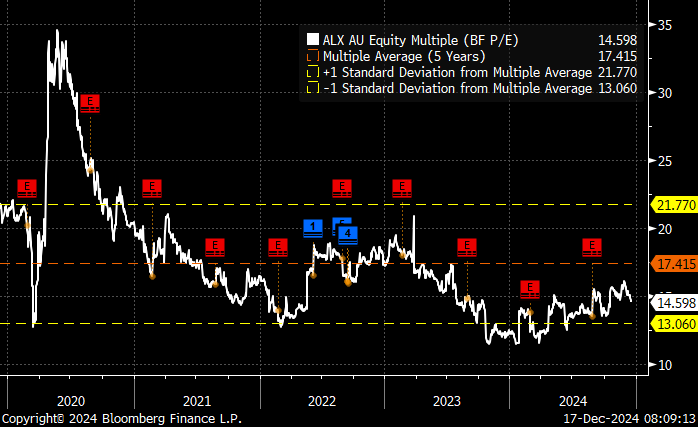

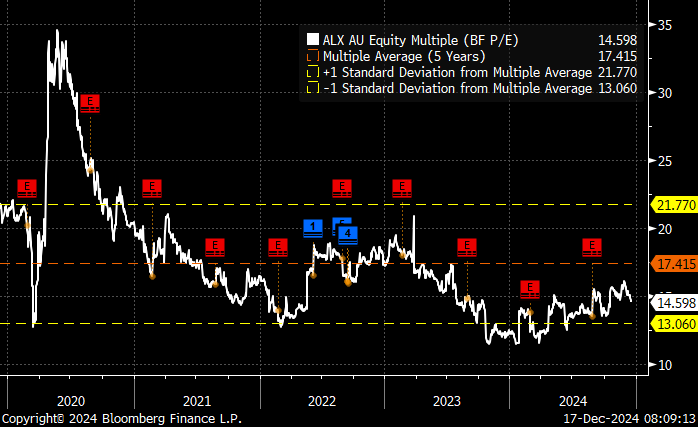

The stock is trading 16% below its 5-year average PE, and the risk/reward is starting to improve with a yield of more than 8%, compensating investors for their patience and contrarian since.

That said, budgetary pressures in France are creating significant uncertainty around future tax policies. With France in turmoil politically and running a budget deficit of 5.5%, above the 3% EU limit, higher taxes are a distinct possibility.

- We continue to watch ALX, believing it’s cheap, pays a high yield and has a good suite of assets, but the trend has been one way for the past 2-years with more certainty in France the key to change this.