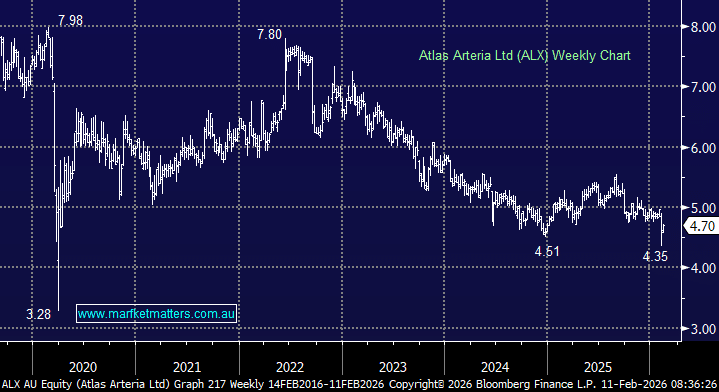

On an 8.5% yield, ALX screens nicely as an income investment, however the underlying business continues to bob along the bottom, which is having the same effect on the share price. Their recent 4Q25 update didn’t move the dial for us. While US assets delivered welcome strength, softer European traffic and lingering funding and tax questions keep the outlook constrained. We don’t own the stock, have reviewed it a number of times, and continue to see fairly neutral underlying trends despite headline yield appeal.

4Q25 trading – US offsets Europe

- Group proportional revenue was ~0.4% below expectations in constant FX.

- France (APRR incl. A79): Toll revenue +1.5% y/y, below expectations, with traffic softer but mix supportive (light vehicles flat; heavy vehicles +1.3%).

- ADELAC: Toll revenue +4.0% y/y, below expectations on modest traffic growth (+0.7%).

- Chicago Skyway: Standout performer. Toll revenue +10.0% y/y on ADT +2.3% — the strongest quarterly growth in years; light vehicles +2.6%, heavy vehicles stabilising.

- Dulles Greenway: Toll revenue +4.2% y/y, beating expectations despite six weeks of US government shutdown.

- Warnow Tunnel: Toll revenue -5.6% y/y as traffic fell -9.8%, cycling roadworks on competing routes.

With traffic now largely known, the focus shifts to cost control and margins (+ French tax). Interest rates globally (bond yields) have remained higher than hoped and this is impacting financing costs and demand for infrastructure assets like toll roads. Transurban TCL is experiencing similar trends in their share price.

ALX are also grappling with the Temporary Supplemental Tax (TST) imposed by the French Government on large infrastructure companies, including APRR — ALX’s largest business by revenue. Recently, the 2026 French Finance Law extended the TST beyond its originally intended one-year life, meaning ALX will be exposed to this tax again in 2026. The tax applies based on revenue in the current and prior year, with most of the payment (98%) due in late 2026 and the balance in 2027. The TST rate is significant: 20.6% of average corporate tax for companies with €1.5–3bn revenue, and 41.2% for those above €3bn — and APRR likely falls into the higher band.

- This extra tax isn’t a trivial levy; it materially increases the effective tax burden on the French toll business and reduces operating cash flows available for distributions or reinvestment.

That said, we still expect ALX to pay a 40cps distribution in 2026, putting them on an 8.5% yield based on yesterday’s closing price of $4.70. However, distributions are not fully covered by the underlying cash flow, and it could be a few years away before that happens.

- Overall, the recent update doesn’t materially change valuation or forecasts; it just reinforced there are still some unknowns (tax) amplified by a mixed operational performance: Strong US performance is encouraging, but softer European trends, tax uncertainty and distribution coverage keep us on the sidelines, for now.