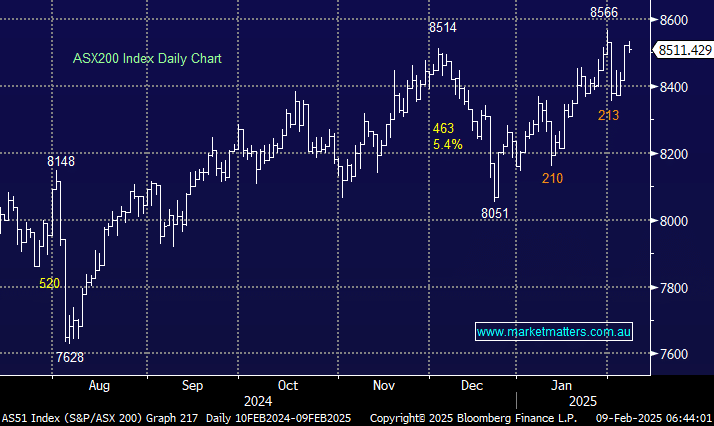

The day-to-day volatility has been increasing lately, which is not unusual on the stock level through reporting season, but ~100-point index swings are. However, with Trump in power, further “fun & games” appear highly likely, but this condition brings opportunity for the prepared. We also have a local federal election due in May and after this weekend’s by-elections, the bookmakers are getting increasingly behind the Liberals, probably a net tailwind for the market, i.e. when Scot Morrisson won against the odds in 2019, the ASX200 surged ~10% in just 3-months.

- Our preferred scenario is the ASX200 tests 8600 in the coming weeks, but we wouldn’t chase such a “pop” at the index level.

The local market is enjoying a degree of strength returning to the resources sector, which is up +1.7% month-to-date and +5.8% year-to-date. Last week, we saw Goldman lift its short-term outlook for iron ore, and copper rallied almost 3% on Friday, testing its four-month high. This is not the first time the miners have threatened to outperform the local market over recent years. However, with last month’s Bank of America Fund Managers’ Survey showing commodity holdings stood at a net 6% underweight, there is room for further upside.

- The SPI Futures are calling the ASX200 to open down 0.75% this morning. It’s not as bad as last Monday, but weakness early in the week are becoming a habit!