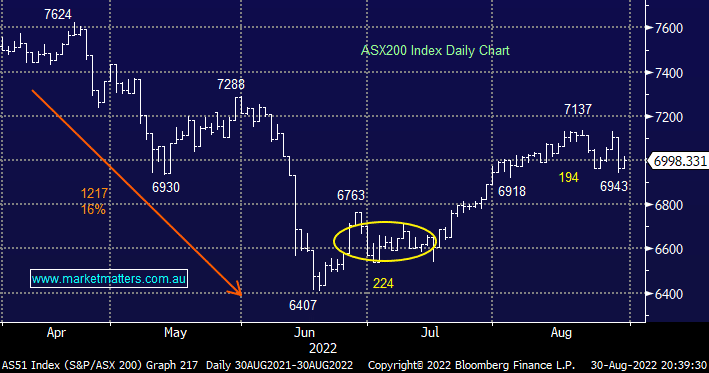

The ASX200 has been meandering around the 7000 area basically all month and it wouldn’t surprise us if September delivered much of the same, pretty much in-line with our recent expectations. So far this year we’ve seen the local market fall by -16% and then bounce +11%, a period of ongoing consolidation is arguably what’s missing from the picture to add some balance although at this stage we believe the risks are still skewed to the downside.

- If our view towards bond yields proves correct we should see further dips towards 6900 and even 6800 for the ASX 200 but we believe this weakness should be faded in anticipation of a strong rally into 2023.

US stocks closed at their lowest levels in a month this morning with all 11-sectors in the S&P500 falling although a -3.4 dip by energy names caught the eye following a more than 5% dip by crude oil. Economic data pointed to ongoing resilience in both the US household and labour markets reaffirming the Fed won’t be easing its path of rate hikes any time soon. Friday’s comments from Jackson Hole look set to hover over equities every time we see strong economic data which is likely to lead to further dips by stocks through September and into October at least.

The SPI Futures are pointing to a test of this week’s ~6940 low following the weakness on Wall Street which fits our view into September.