The international equities portfolio had a good week, up ~6% before a detraction from the currency. However, our weakest holding was Apple, down ~3% following weaker-than-expected pre-orders of their new iPhone 16 Pro series. Bloomberg Intelligence tells us that the waiting time on the new model is 21.5 days for orders taken within 72 hours of launch which compares to 32.5 days for the iPhone 15. That highlights weaker demand, and the shares fell as a consequence. This is all very micro, and we caution against being so short-term in nature, particularly given this is such a monumental launch for Apple – their first AI-enabled iPhone, built from the ground up, according to Tim Cook, though the AI part (Apple Intelligence) is not quite ready!

- This is the key selling point of the phone, and while Apple Intelligence could be out as early as October, the mismatch between the timing of the phone and its AI grunt is not ideal, however, we’d rather they get it right than rush a launch.

Apple Intelligence will provide AI writing tools that help craft emails, generate email summaries, distil down news articles, record calls and provide AI-generated transcript features, AI-enhanced Siri and even AI emojis called ‘GenMoji.’ While these features are only scratching the surface, the key takeaway is that AI will save time and improve productivity across many aspects of our lives.

As a recent note from Citi highlighted, they see three stages of the AI rollout, with the first two being infrastructure plays – the chips and servers, then networking and storage and finally, devices that bring “consumer-ready smaller AI models” to the masses in a regulatory-compliant way. This is where Apple comes in, ideally positioned in this space, which underpins Citi’s call on Apple it’s their no 1 global pick for AI.

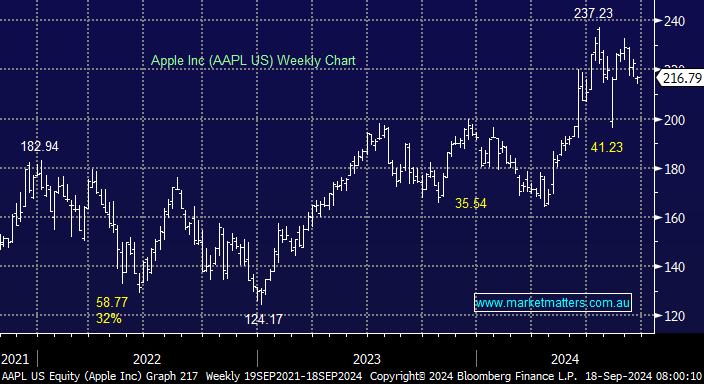

- We previously expressed some caution regarding our position in Apple; however, we remain comfortable with our 5% target weighting in the International Equities Portfolio.