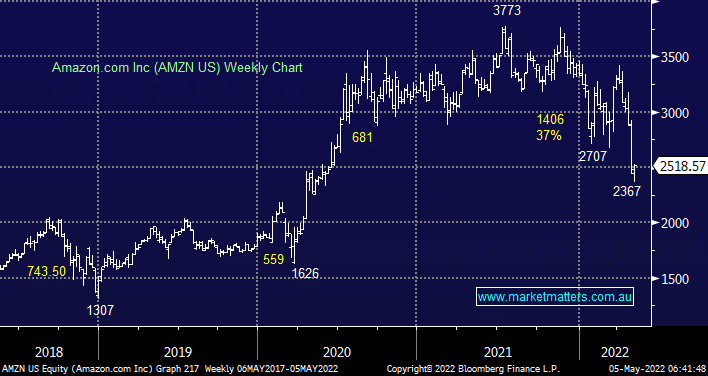

Amazon has been clobbered over the last few weeks following its latest earnings report taking the shares down to levels not seen since mid-2020 i.e. the “buy the dip” attitude has clearly waned towards growth stocks. Unlike Netflix (NFLX US) which is facing serious risks to its business model AMZN experienced some weak e-commerce results in the short term but one quarter doesn’t set a trend. Amazon Web Services continues to deliver strongly and while the on-line goliath has suffered from recent inflation pressures such as construction costs and labour shortages, these hopefully will prove to be transitory issues. While we see no reason to panic Its likely to be a while until AMZN regains market traction and MM are looking to cut our holding into a bounce – hopefully!

scroll

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is now neutral Amazon (AMZN US)

Add To Hit List

Related Q&A

Do you like Amazon (AMZN US) around $US90?

Does MM like Amazon at current levels?

Thoughts on international stocks

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.