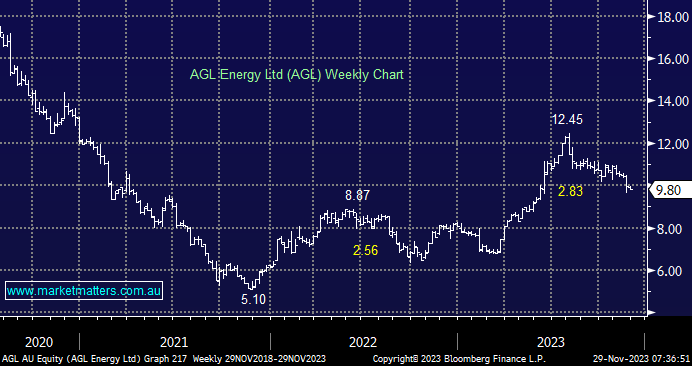

AGL has dipped back below $10 this week having hit a high of $12.45 at the start of August. Most of the attention in the space has been focused on Origin Energy (ORG) as the tussle between potential acquirer Brookfield and major shareholder AusSuper continues to fill the papers. AusSuper is digging its heels in, essentially looking long-term around valuation and using that lens, they believe Brookfield’s bid undervalues the ORG assets. While this plays out, AGL has flown somewhat under the radar and we’re back contemplating our existing position in the Market Matters Active Income Portfolio, posing the question, should we be adding to our small 3% weighting?

AGL was in the news yesterday as their CFO presented at an AFR Summit, with some interesting comments around the demand outlook for electricity and how they intend to meet it. Essentially, they believe EV’s will underpin a 30% increase in home electricity consumption as drivers plug in their cars to recharge overnight, and while Electrification of the grid via hydro, wind, solar and batteries is crucial in the transition away from coal-generated electricity, the rising demand outlook means that a lot more renewable infrastructure needs to be built before coal-fired power stations can come off line.

- AGL will be critical in the energy transition and shift to decarbonisation, and now it trades on an Est PE of 9.5x and a projected yield of 5.5% with franking increasing, we think AGL is very much in an accumulation zone.