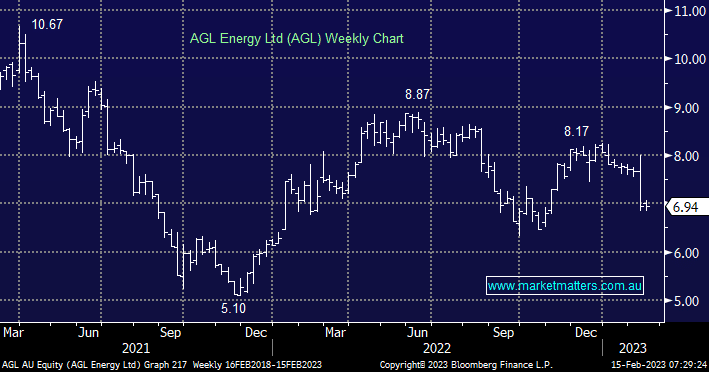

If we told you AGL Energy was set to grow earnings at a quicker pace than CSL next year while paying an ~8% yield, would you believe us? A comparison that is clearly unfair to CSL given the quality of that business and the returns it has provided for investors since listing, however, there is a very real chance that AGL will double earnings in FY24 and grow them by another 20% in FY25, all while paying 75% of profits out as dividends, which based on the currently depressed share price under $7, will equate to a yield of ~8% and ~10% respectively. How? AGL’s earnings will benefit significantly from higher wholesale electricity pricing as their historical ‘hedges’ roll off.

On consensus numbers, AGL will generate earnings per share (EPS) of 84c in FY24, a 125% increase in FY23, while analysts think FY25 will deliver EPS of $1.00. They do have ambitious targets for decarbonization, and these targets are what drove the big statutory loss of over ~$1bn at last week’s result, however, that was simply a non-cash write-down of their coal-fired assets that will close earlier than previously thought. If we think about the ‘new AGL’ which starts to sell the vision of renewables and makes very tangible steps towards making that a reality, while growing earnings strongly, and perhaps leveraging their ~4.5m strong customer base into things like internet or even insurance, the narrative could change very quickly. FY23 is being a tough year, however, they say it’s always best to buy straw hats in the winter!