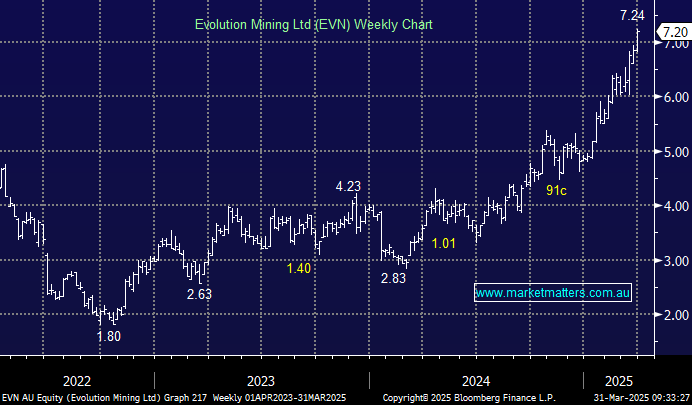

Inline with comments in this morning’s note, we believe Gold is approaching a pivot point where traders are now ‘too long’ the precious metal. We are also concerned about Copper in the short term. Combining these (short term) views, we are selling into the prevailing strength in EVN. We’ll revisit the sector/stock at a later date, believing the sidelines are the best place to be for now.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM are selling EVN in the Active Growth Portfolio, taking profit around $7.24

Add To Hit List

In these Portfolios

Related Q&A

What do you mean by “fade the move”?

Evolution (EVN) v Ramelius (RMS)

Miners with both gold and copper exposure

Gold Stocks

Gold Stocks

Gold miners

GOLD

Gold vs EVN and NST

MM’s preferred gold stocks?

Silver and gold movements

Can MM see Evolution (EVN) as a takeover target?

Thoughts on Evolution (EVN) SPP

Potential escalation between Israel and Hezbollah

Does MM like SLR, NST and Gold into previous metals weakness?

Where would MM buy Evolution Mining (EVN)?

Does MM like buying gold stocks in weakness?

Thoughts on the 2nd tier gold shares please

How much upside does MM see in the likes of EVN?

Does MM like Gold Stocks For Income?

What are MM’s thoughts on gold stocks EVN & NST?

Does MM prefer RRL or EVN for gold exposure?

Is the rise in Gold sustainable?

MM thoughts on Evolution Mining (EVN) SPP

Question on EVN & A2M

OGC

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.