A2M experienced a significant re-rating in February after delivering a stellar result, with revenue surpassing expectations by 10%. Given A2M’s strong execution, we now expect further market share gains in both China, Australia, and New Zealand – note that around 67% of FY24 revenue was generated from China. The launch of a second China Label (CL) product, as part of its planned supply-chain investment, in our opinion, isn’t fully factored into the share price.

The stock has performed well driven by a combination of earnings growth and a rerate higher of the earnings multiple. We expect strong top line revenue growth in FY25 of ~12% driving earnings growth nearer 20%, however that does taper off in outer years, with growth in earnings more likely to compound around 12% – still a strong rate of growth and on 28x, it’s not excessively expensive.

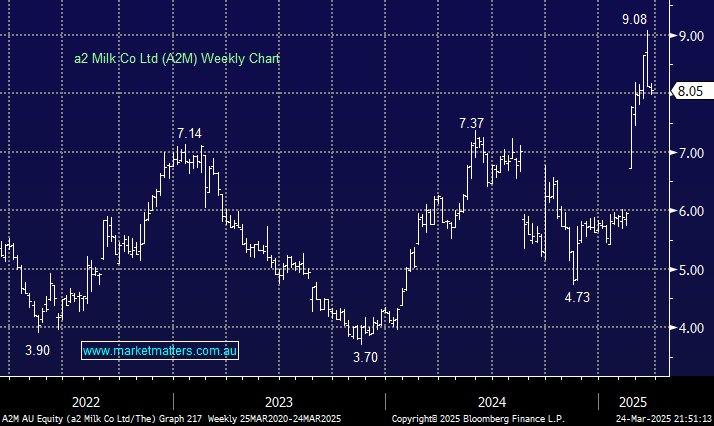

- We like A2M in the $7.50-8 region, but it’s not on our radar at present.