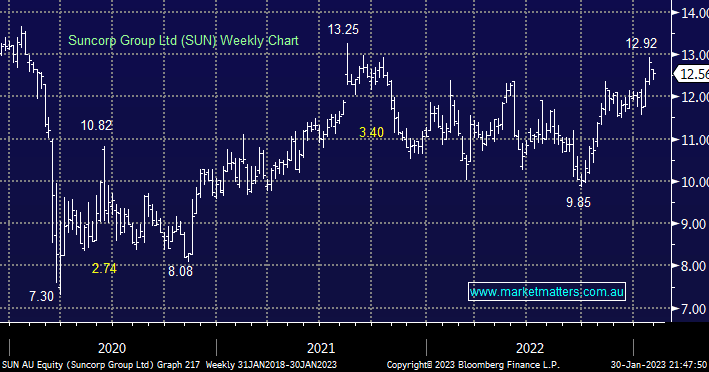

SUN has a smaller exposure to NZ than IAG due to its specific reinsurance cover towards NZ resulting in a maximum exposure of ~$46mn hence the stock only slipped -1.95% yesterday. SUN has been tracking the banks this year rallying +4.3%, similar to National Australia Bank (NAB) +5.89%, prior to yesterday’s dip. At MM we’ve been bullish on the Banking Sector for a long time but now the likes of Commonwealth Bank (CBA) are testing their all-time we have migrated this call from a bullish to a neutral/mildly bullish stance.

- We like SUN back under $12 if/when we see a market correction in 2023.