IT stocks once again offer most support, market edges higher (BVS, LNK, TYR)

WHAT MATTERED TODAY

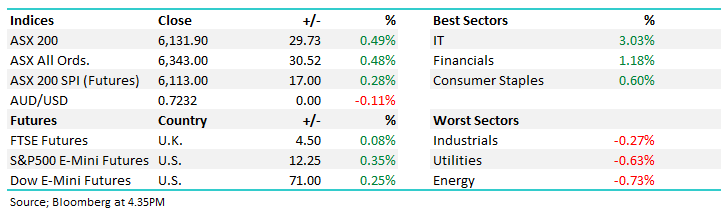

A reasonable session to kick off the week with the IT stocks building on last weeks solid performance putting on +3% while the financials were also well bid rising more than 1%. AGM season is now upon us with a number of companies out today, commentary from Bingo (BIN) which was in line with recent updates was one we had most interest in (resides in the MM Growth Portfolio), although we did see Ian Malouf sell a few million shares - Ian was the founder of Dial-a-dump (DADI) and is now BIN’s second largest shareholder behind MD Daniel Tartak, although he spends most time on his 52m super yaucht – ‘Mischief’. The Diggers and Dealers event is on in WA (Kalgoolie) + is being live streamed, Fortescue (FMG) headlining the card tomorrow.

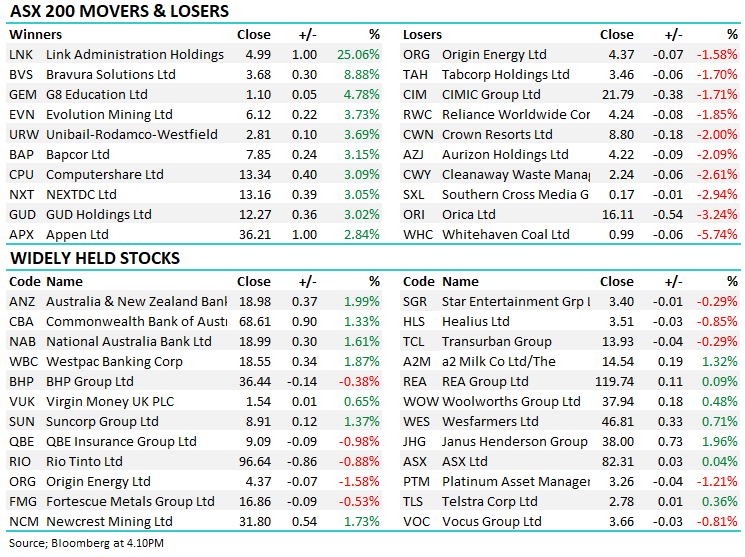

The market ticked around in a tight 20pt range for most of the session before ticking higher into the close, finishing on the session highs. MM holds 2 of the top 3 gaimers today (BVS +8.88% & Z1P +5.69%), which is nice, Link (LNK) which Harry covers off below the star adding +25% on a takeover.

Asian markets were mostly bullish today, Japan flat however Chinese stocks rallied nearly 3% on data that showed money supply was high and new loans were strong. All the talk in the US media centres around stimulus however the traders I speak with arn’t expecting anything pre-election, instead it seems the consensus is looking for a big post November deal, whoever gets in. US Futures edged higher during our time zone

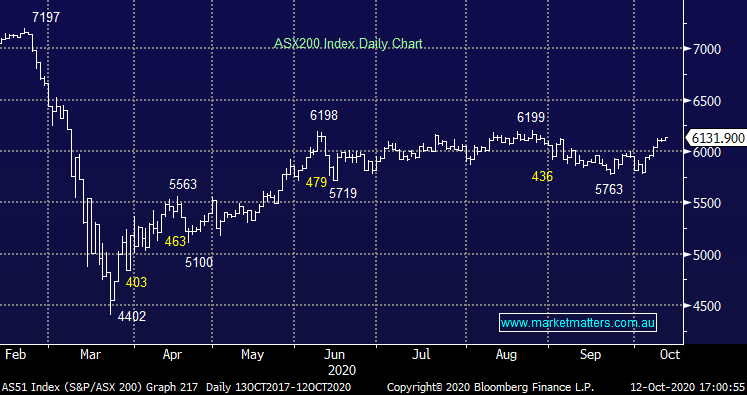

By the close, the ASX 200 was up by 29pts / +0.49%. Dow Futures are trading up 70pts/+0.25%

ASX 200 Chart

ASX 200 Chart

CATHCING MY EYE

Bravura Solutions (BVS) +8.88%: A good session after announcing a deal to acquire Delta Financial Systems in the UK for around $40m. Delta are software specialists in the UK pension space with the acquisition fitting into Bravura’s core Sonata offering. They say the deal will be earnings accretive in FY21 with Delta growing their top line at 20-30% pa. BVS has been a weak performer in our growth portfolio since acquisition, however today’s announcement could be the catalyst to turn the needle. At the time of their recent results, it was their conservative guidance for flat YoY growth that prompted the sell-off, today’s announcement obviously paints a more optimistic picture than that, hence the pop in the share price. We remain bullish and if BVS can surprise in terms of earnings growth, they’ll also capture a P/E re-rate.

Bravura Solutions (BVS) Chart

Link Administration (LNK) +25.06%: A private equity consortium lobbed a bid for Link today, valuing the administration and share registry business at $5.20/share – a nice 30% premium to yesterday’s close. The bidders are led by Carlyle Group & Pacific Equity – PEP sold down its stake in LNK’s 2015 IPO. Link’s largest shareholder Perpetual (PPT) has indicated it would support the bid in the absence of any superior offer. Link shares closed at a 5% discount to the offer - there are a few conditions to be met and the group will need to do there DD first before making a binding offer – I hope that doesn’t include trying to change anything or do any sort of administrative work on a holding – they’ll run a mile!

Link has had a tough time over the last few years with pressure on all sides of the business – superfund administration fees are tightening, early access super withdrawals didn’t help and it’s UK exposure took a big hit with BREXIT uncertainty. At around $5 a pop, it’s not a bad chance for long suffering LNK shareholders to take the money and run.

Link Administration (LNK) Chart

Tyro Payments (TYR) +6.67%: this morning released its weekly trading update during COVID. We haven’t provided an update for a few weeks so this catches us up. As a reminder we provide TYR data for sector interest. TYR is one of the largest points of sale terminal providers in Australia and has been growing/taking share off the majors.

Key takeout’s from Jono Higgins

· Weekly transaction volume to 9th of October was $65.4m per day, this grew +11% vs the prior week;

· Weekly volume to the 9th was the highest daily average for payment volumes during CY20 to date. A record for this year. Closest to the mark was the first week of July wherein volumes were $63.1m;

· Volume to the 9th of October is up 11% MoM and now 9% YoY. This is a relatively strong result considering the environment. TYR volumes with Victorian restrictions likely to loosen a little this weekend are likely to comp higher materially over the next quarter in our view; and

· This is positive for more the offline and recovery players if this trend continues. Categories continuing to do well include electronics, outdoor, home improvement amongst others.

Tyro Payments (TYR) Chart

BROKER MOVES

· Sydney Airport Raised to Overweight at Morgan Stanley

· Newcrest Raised to Buy at Citi; PT A$37

· ANZ Bank Raised to Overweight at JPMorgan; PT A$20

· Silver Lake Cut to Hold at Canaccord; PT A$2.50

· Rio Tinto Cut to Hold at Shaw and Partners; PT A$99.99

· Janus Henderson GDRs Raised to Neutral at Credit Suisse

· South32 Cut to Hold at SBG Securities; PT A$2.37

OUR CALLS

No changes today

Major Movers Today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.