Market Matters Weekend Report – ride the wave!

Before I think about the weekend report I like to update the chart pack and do some reading or news and research, listening (podcasts particularly from the US) – research – looking for as many “light bulb” ideas as possible. Usually there are a number of different thematics which catch my attention and hence the report starts coming together, obviously by definition the intention is to make the missive topical and useful for subscribers over the coming weeks / months. In today’s rapidly evolving market if we don’t keep our finger on the pulse we might as well be writing about the Napoleonic Wars.

This weekend it feels like all the stars have aligned for global stocks to rally sharply higher:

1 – As Bloomberg so perfectly wrote on Saturday “Never mind the narratives, this market wants to go higher” equities have just enjoyed their best week in over 3-months in the face of a number of major uncertainties and theoretical headwinds.

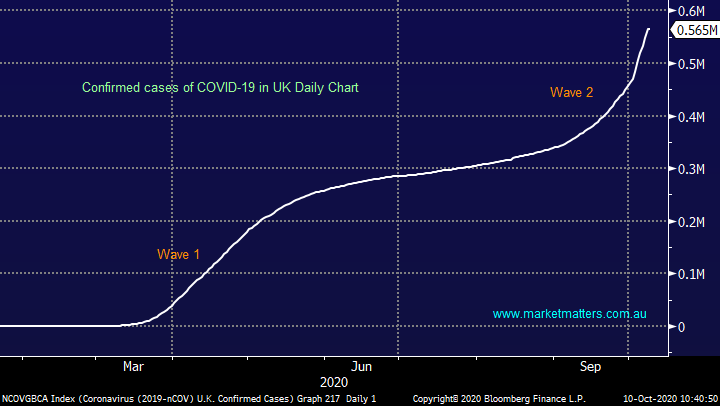

2 – Equities have remained buoyant even as COVID continues to escalate across the globe, the UK is now witnessing more than double the number of daily coronavirus infections than in March & April i.e. a market that rallies on bad news is a strong market.

3 – The bears are hurting, only around a week ago the tech based NASDAQ was carrying a record short-position yet during the week the advance-decline line, the common measurement of market breath in the US, hit a record high for the S&P500 index – technically a very bullish backdrop.

4 – The US small cap Russell 2000 Index has just enjoyed its best weekly performance in 4-months implying markets are anticipating ongoing huge stimulus and relief packages, whoever wins the run to the White House.

It’s easy to justify being in cash, holding stocks feels far tougher psychologically but yet they remain an extremely strong asset class. As interest rates head even lower, which is tough as they’re already close to zero, investors are struggling to justify alternatives which is fuelling this already strong bull market e.g. Australian term deposits have slipped under 1% yet CBA shares yield 3% fully franked. Today I’m going to show a few pieces of the puzzle which illustrate why MM remains bullish and happily long stocks, and then importantly where we anticipate taking some money off the table if this bullish view unfolds.

MM remains bullish equities.

Confirmed cases of COVID-19 in the UK Chart

The ASX200 is already up 5% this October, statistically it would be easy to justify taking some profits but considering we’ve gone sideways since the end of June it’s still easy to comprehend our preferred scenario, a rapid assault towards 6500, now only ~6% away. Today we will look at a few major stocks / sectors which makes us bullish the local index and as we said earlier where MM is planning to increase our cash levels - the MM Growth Portfolio is currently 5% in cash.

MM remains bullish the ASX200 ideally targeting ~6500 before Christmas.

ASX200 Index Chart

The more I read during the week the greater one phrase came to the front of my mind – “what’s not to like”, the stock / sector rotation which has glued the index to the 6000 area feels like its come to an end. Everywhere I looked stocks, sectors and indices looked great with only a few pockets around the defensives looking average, but the key takeaway was nothing looked bearish. I was listening to a podcast yesterday while mowing the lawn, titled the upside down market, which articulated pretty well the reasons why stocks were rallying when the economy is weak, it’s essentially stimulus and money supply , and the evolution of fiscal policies that governments around the world have embraced.

Today I have briefly summarised 10 areas which reinforced our bullish stance towards equities including important upside targets in a few cases where the risk / reward will become skewed towards a more conservative stance towards stocks i.e. increase levels of cash.

1 Global Indices

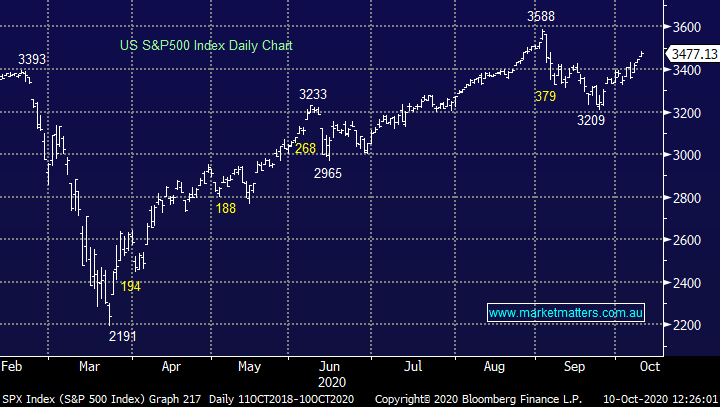

The widely followed US S&P500 index has rallied from Septembers low as we anticipated hence as the old saying goes “if it ain’t broke don’t fix it” MM remains bullish US stocks targeting fresh all-time highs, initially 4-5% higher. European Indices look set to play some performance catch up, similar to ourselves last week, with the EURO STOXX’s upside target 6-7% above Fridays close.

MM is bullish the S&P500 initially targeting 3600, or 4% higher.

US S&P500 Index Chart

Under the hood the technical picture remains arguably even clearer with the tech space still leading the charge – Amazons (AMZN US) upside target is ~$US3600, or 9% higher. Elsewhere in the sector the picture is the same from heavyweight Microsoft (MSFT US) to relative new kid on the block Salesforce (CRM US).

MM is still expecting outperformance form the high beta Tech Sectors over coming weeks / months.

NB when the likes of AMZN reach our targets we anticipate taking at least some profit across our portfolios.

Amazon (AMZN US) Chart

2 Commodities & Resources Sector

The $US appears to have lost its battle to bounce higher, sending commodities up strongly over the last 2-weeks with some of the moves gathering momentum on Friday e.g. silver rallied +5.5%. We believe precious metals are leading the whole Resources Sector back towards their recent early August highs – remember the Materials represent almost 20% of the ASX200.

MM is bullish silver looking for over 20% upside.

NB again, when the precious metals reach our target’s we anticipate taking profit accordingly across our portfolios.

Silver ($US/oz) Chart

Also, we believe Iron Ore has finished its 14% correction and is again headed up to test 900 CNY/MT, around 8% higher. Hence MM is bullish the sector short-term but we will be looking to fade the targeted rally across our portfolios.

Iron Ore January 2021 Contract (CNY/MT) Chart

3 Crude Oil & Energy Sector

Crude oil remains within striking distance of its 2020 high, yet the sector has struggled since June as the non-believers took control. Simply we believe they are wrong, and oil has commenced its journey towards fresh post March highs, understandably still well below the pre-COVID levels last Christmas.

MM is bullish crude oil looking for ~10% upside.

Crude Oil December 2021 Futures Contract ($US/barrel) Chart

The picture is very similar for stocks in the sector with Santos (STO) looking positioned to test $6.50 into Christmas, over 20% higher but again significantly below its $9 area in January – this is one area we can see outperforming into Christmas.

MM is bullish the Energy Sector – less than 4% of the ASX but it all helps.

Santos (STO) Chart

4 The Australian Banking Sector

We covered the Banking Sector in Thursday’s Morning Report with the conclusion: MM expects outperformance from the banks into 2021. So far its felt like everybody’s embraced our thoughts with Westpac (WBC) for example rallying over 10% last week alone. However, what really caught my eye was sector underperformer Bank of Queensland (BOQ) which finally looks bullish from a technical standpoint, with an initial upside target over 10% higher, a great read through for the sector. This also coincides with the recent outperformance by the Russell 2000 in the US i.e. money is flowing into smaller companies that have so far dragged the chain in 2020.

MM is bullish the banks at current levels - over 20% of the ASX200.

Bank of Queensland (BOQ) Chart

5 Consumer Services – the recovery stocks

COVID numbers are remaining stubbornly high across the globe but investors are clearly embracing the prospects of a vaccine in 2021 plus of course we’re no longer plagued by the fear of the unknown although the economic pain from containing the virus is significant. We remain happy with our exposure to the recovery story via Star Entertainment (SGR) but elsewhere the picture is also bullish from G8 Education (GEM) to SkyCity (SKC).

MM remains bullish the recover stocks into 2021.

Star Entertainment (SGR) Chart

6 The Australian IT Sector

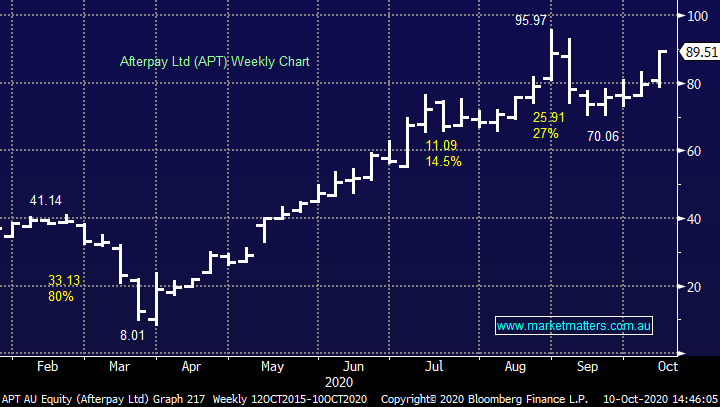

We’ve written about the IT Sector a lot of late, especially since MM has moved overweight in our Growth and International equities portfolios, there’s no great change since our report on Friday 2nd i.e. MM remains bullish looking for sector outperformance. Top performer which we happily own Xero (XRO) has already soared over 12% to fresh all-time highs in October, many of its sector peers will follow in our opinion. The BNPL group has been a volatile subset of the IT Sector and like a few stocks / sectors it’s still dancing the MM post-March jig, we remain bullish APT targeting a test of $100, around 10% higher.

MM is bullish the IT Sector – now 4.5% of the ASX200.

Afterpay Ltd (APT) Chart

7 Healthcare Sector

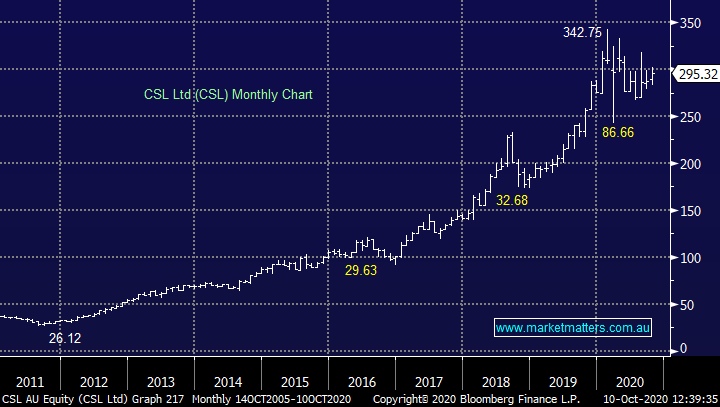

As we covered in Fridays Report the Healthcare Sector is awakening from its slumber, MM now believes it can finally keep pace with the market which of course we are bullish. Market & sector heavyweight CSL has been in the naughty corner for most of the year but while we have no interest chasing the stock around $300 another challenge of $350 wouldn’t surprise us.

MM is bullish the HealthCare Sector – 12% of the ASX200.

CSL Ltd (CSL) Chart

8 Commercial & Professional Services Sector

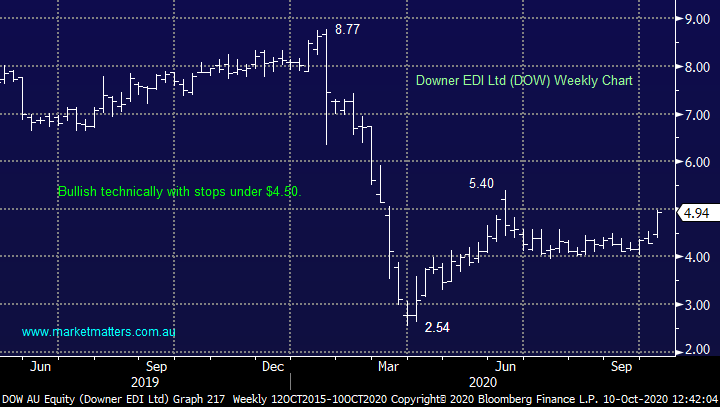

Bingo (BIN) which has given our Growth Portfolio a rocky ride in 2020 finally broke out to post March highs last week, around 50% above its July swing low. We believe the sector will follow suit with Downer (DOW) shown below poised to gain 10-20%.

MM is bullish the sector expecting a number of the stocks to follow BIN higher.

Downer EDI (DOW) Chart

9 Retail Sector

The Retail Sector is not surprisingly highly correlated to the “Consumer Services – the recovery stocks” discussed in point 5 and hence no surprise we are bullish. However, we believe the horse has largely bolted on this one although another 10% upside by JB Hi-Fi (JBH) would not surprise.

MM is bullish retail, but we believe the “easy money” is behind us.

JB HIFI (JBH) Chart

10 Capital Goods / Industrials Sector

The Capital Goods Sector looks really good in places, we have an upside target for our recent purchase of Monadelphous (MND) over 20% higher.

MM believes parts of this sector like MND can outperform into Christmas.

Monadelphous Group (MND) Chart

Conclusion

MM remains bullish and long stocks monitoring our target areas carefully with a view to increasing cash levels into decent strength.

Our Holdings

Our positions as of Friday. All past activity can also be viewed on the website through this link.

Weekend Chart Pack

The weekend report includes a vast number of charts covering both domestic and international markets, including stock, indices, interest rates, currencies, sectors and more. This is the engine room of our weekend analysis. We encourage subscribers to utilise this resource which is available by clicking below.

Have a great Sunday!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.