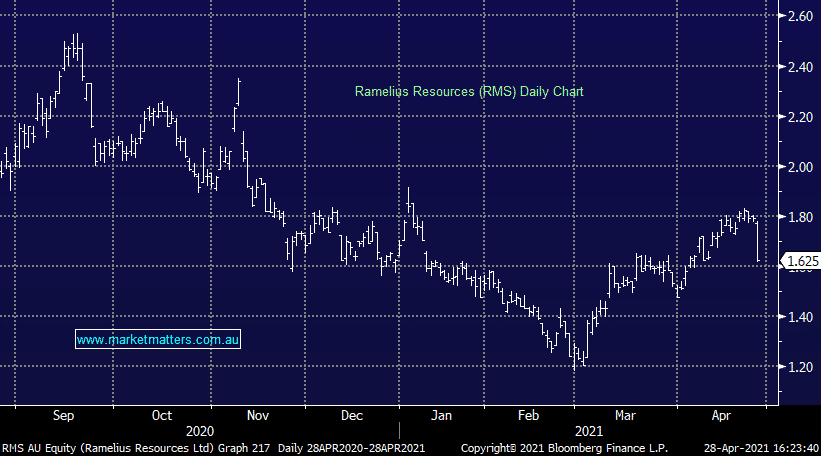

RMS -9.22%: The gold names were broadly weaker today however WA based Ramelius was the hardest hit on a mixed March quarter update. The company pushed gold production guidance to the top end of the range for the full year on a big 66koz of production the quarter just gone. That did come with increasing cost guidance to the higher end of the range of $1,280-$1,330/oz after being slugged $1,370/oz in the March quarter. The theme is a common one among the miners who are being forced to pay up for labour in a tight market. Ramelius has a handy cash balance of $230m with just $8m in debt – a balance sheet they have been aggressively putting to work with a number of acquisitions and exploration spend which is unlikely to slow down any time soon.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is bullish Gold, preferring NCM

Add To Hit List

Related Q&A

Evolution (EVN) v Ramelius (RMS)

Gold stocks & ETfs

Gold juniors miners

Thoughts on the 2nd tier gold shares please

A question on Bitcoin & Ramelius Resources (RMS)

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.