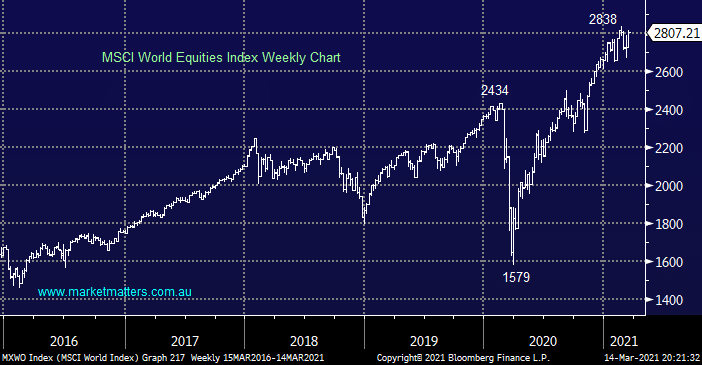

Global stocks look poised to make fresh all-time highs with an initial target 5-10% higher, the air might be getting thin be we don’t yet believe it’s time to press the eject button just yet although we are comfortable slowly reducing equity holdings on a stock by stock basis. Technically the indicators we follow are ok if a little stretched e.g. the Advance – Decline line has now surged to a higher high, along with prices, implying for that critical element liquidity is just fine and the bullish uptrend should continue.

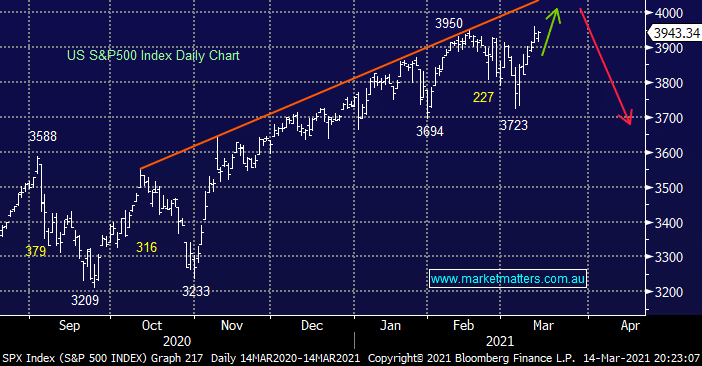

The US major S&P500 index rallied an impressive 2.7% last week, touching fresh all-time highs In the process, even while the heavyweight tech stocks continued to experience some wild gyrations although they did finally manage to close higher. We remain committed to our short-term view that tech stocks will regain some of their mojo, helped by a pull-back in bond yields, enabling the broad market to add to last week’s gains – it’s important to remember tech stocks now make up ~25% of the S&P500.

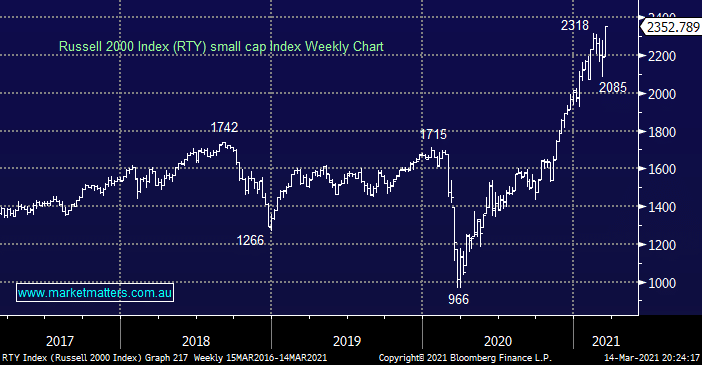

Last week the Russell 2000 was our “Chart of the Week” with the conclusion being we remained bullish with a target 8-10% higher, not a bad call as the index popped over 7% last week to fresh all-time highs. This rally is testament to the unprecedented liquidity literally sloshing around in financial markets plus small caps being an ideal proxy to the growing economy. At this stage bond yields are only significantly influencing the previously hot growth IT stocks but interestingly the last time bond yields scarred investors back in Q4 of 2018 the Russell 2000 underperformed providing another sign to MM that things are still presently ok for equities.