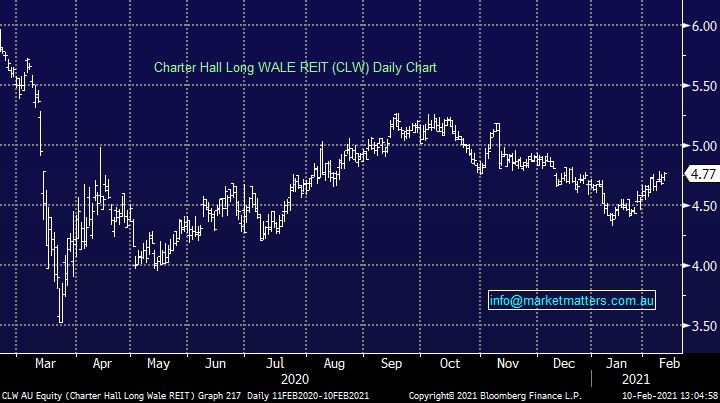

Charter Hall LONG WALE REIT (CLW) went early and reported 1H results yesterday, it was actually scheduled for today. This is a stock we held and sold from the Income Portfolio recently given the pending headwinds from rising bond yields, and while yesterday’s result was solid, their guidance for a least 2.8% growth is not enough as bond yields rise. They’ve clearly come through COVID well and that’s because of their solid long term tenant base, however looking forward they’ve guided to “no less than 29.1cps” and that’s not good enough when rates are rising. CLW has a dividend of 6% which is clearly attractive, however growth in earnings is low and the market will become more concerned (as we are) about long duration assets.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM views CLW as around about fair value here, but growth will be hard to come by

Add To Hit List

Related Q&A

Which REITS have the most capital upside?

Thoughts on Charter Hall REIT (CLW) after its result?

Does MM like REITS CLW & CHC?

What does MM think of CNI, CLW & LLC into current weakness?

MM’s Thoughts on CLW?

MM thoughts on CLW

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.