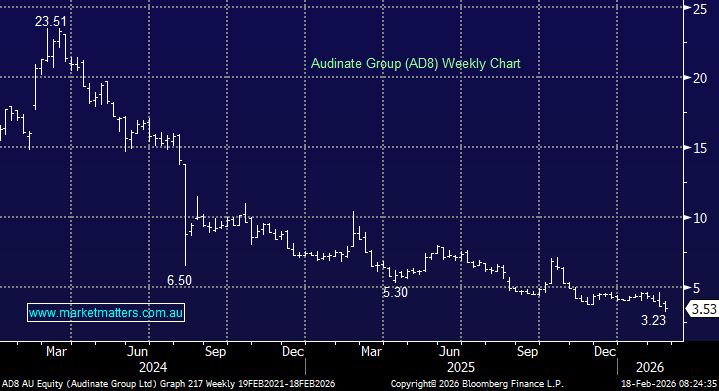

Audinate’s 1H26 result marked a return to growth, but it also reinforced our view that FY25–26 are not normal years for the business. Post-COVID distortions, inventory digestion and US tariff uncertainty continue to weigh on near-term momentum. That said, the long-term investment case remains intact, and we think the market is pricing in very little upside.

1H26 Highlights

- Gross profit: US$17.4m, +12% YoY — around 3x market growth and in line with expectations.

- Growth was lower quality than in prior years, with Avio adapters (+51%) doing the heavy lifting.

- Core chips revenue fell (-4%) and software grew +14% — positive, but still well below historical run-rates.

As a refresher, Audinate enjoyed an unusually strong period through FY22–24, with gross profit growing 30%+ as customers stockpiled inventory and pulled forward education and corporate spend during chip shortages. That tailwind has now reversed.

- Management says inventory headwinds have largely cleared

- Forward orders underpin FY26 USD GP growth guidance of 13–15%

- We see upside risk to medium-term expectations, which currently assume a much more muted growth profile

Overall, while not a lot of upside baked into the share price at current levels, we still think it’s too early to wade back into AD8. There will be a time, it’s just not yet!