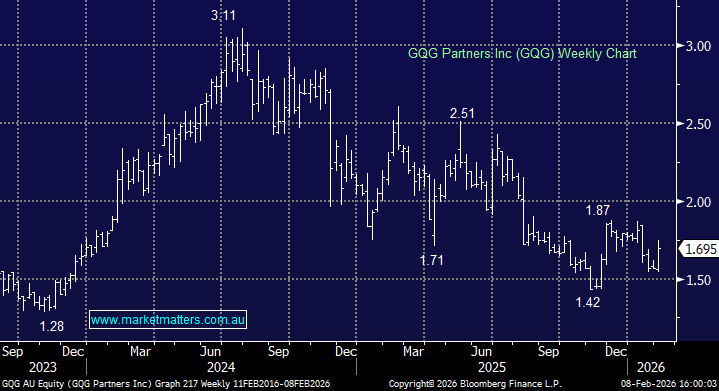

We hold GQG in our Active Growth and Income Portfolios believing amongst other things that outflows will slow or even reverse as questions are asked towards tech valuations. As a fund manager, GQG has bucked the trend and exited the growth stocks which led to underperformance and painful outflows over the past year or so, but the last few weeks has started to support their view. This mornings expected strong open by the ASX could see some early weakness in GQG which we believe will provide some attractive risk/reward from a trading perspective.

- We are initially targeting the $2 area for GQG, back towards its mid-2025 levels.