The S&P 500 reversed lower overnight as selling in big tech and Microsoft in particular weighed on the market. A tumble in software stocks added to the losses, as fears grew among investors that AI spending was not yet yielding adequate financial returns. ServiceNow shares tumbled buy -12% even after better-than-expected earnings and revenue for the fourth quarter. Shares of Oracle and Salesforce moved lower by 2% and 6%, respectively, while the iShares Expanded Tech-Software ETF (IGV), a key proxy for global software stocks, slipped into bear market territory, plunging up to 5% to sit ~22% below its recent peak – the sell-off saw IGV endure its largest one-day fall since last April’s tariff-driven rout, underscoring just how quickly sentiment has turned on the sector.

In cryptocurrencies, Bitcoin shed 6%, hitting its lowest level in almost two months, demonstrating a risk-off environment and preference by the punters for precious metals.

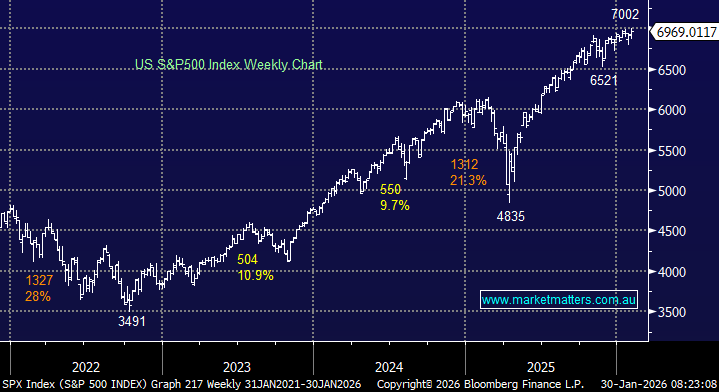

- We feel the flagship US index is looking tired as it posts new highs, leading us to retreat from our bullish stance.