Last week, EVN delivered a strong December quarterly, with the gold/copper producer cutting its all-in sustaining cost (AISC) forecast for the full year by ~5.5% to $A1640-1760 – remember this morning gold is trading around $A7,300/oz. The company maintained FY26 production guidance which given the price of metals will drive very strong cash flow.

EVN caught our eye on Tuesday, slipping 10c as most copper and gold names remained strong. This morning we contemplate if the miner has run ahead of the underlying gold and copper price, in other words, is it pricing in higher prices through 2026, diminishing the risk/reward as it tests $15

The latest quarterly report showed the business is rapidly becoming a “cash cow”:

- Quarterly gold production of 191,000 oz, at $A1,1275 AISC, would deliver revenue of $US974mn based on $US5100 today – 80% of core revenue.

- Quarterly copper production of 18,000 tonnes would deliver revenue of $US238mn based on $US13,200 today – 20% of core revenue.

- The cash balance improved by $967mn after paying $110mn debt and paying out $116mn in dividends.

The company remains on track to deliver production this year of 710,000 to 780,000 ounces of gold and 70,000 to 80,000 tonnes of copper. In FY25, revenue came in at $4.4bn, but with gold and copper at current levels, future revenue in the years ahead is set to be significantly higher, enabling potential capital initiatives such as buybacks or special dividends.

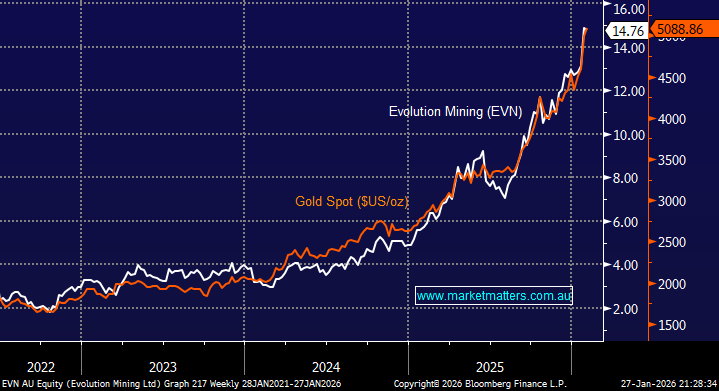

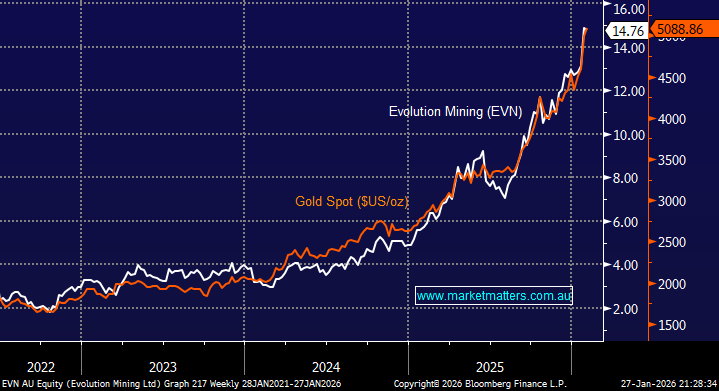

Firstly, let’s consider EVN from a gold perspective, which is where the majority of EVN’s revenue is generated. Markets are expecting similar gold output for EVN in FY27, and with EVN only hedging a small portion of its production, the miner is very leveraged to movement in the precious metal, in both directions. The chart below illustrates the direct and close correlation between EVN and the gold price. The stock has not run ahead of the precious metal, and the future earnings profile looks compelling at current levels.

- EVN continues to trade closely with the underlying gold price.

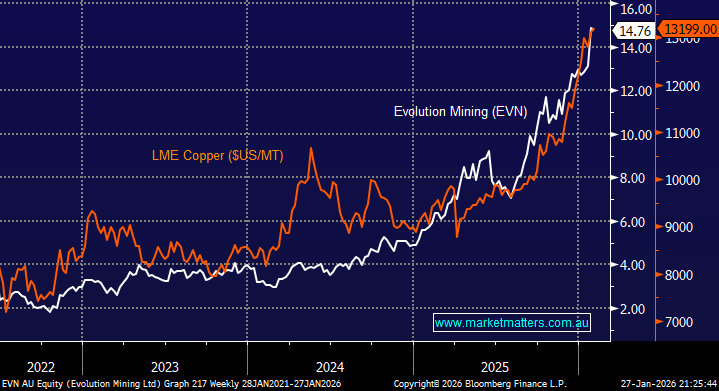

Secondly, let’s consider EVN from a copper perspective, not where its main revenue is generated but still a meaningful contributor. We expect 2026 to be the year the market experiences real copper tightness on increased impediments to supply, putting the market into deficit and driving sustainable price upside and adding to EVN’s tailwind.

- EVN is also following the copper price fairly closely, but that could disconnect if the industrial and precious metal starting walking a different path.

Moving forward, Evolution’s core mines have long mine lives (to 2038–2042 and beyond), and expansions plus reserve extensions are expected to support sustained production, with potential for modest growth rather than material declines. Hence, the companies $30bn valuation doesn’t feel stretched, especially if gold and copper remain well supported in the years ahead – perhaps they will be tempted to increase their hedging slightly.

- We believe EVN is a “buy the dip” stock through 2026, bearing in mind it pulled back over $2 twice in 2025, even as the stock and sector surged higher.