On Wednesday Paladin Energy (PDN) reported 2Q production of 1.2m pounds of uranium oxide, up 15% from the prior quarter, led by an increase in mined ore. Importantly, they guided well for the full year, expecting expects FY production to come in toward the upper end of its previous guidance (4m-4.4m pounds).

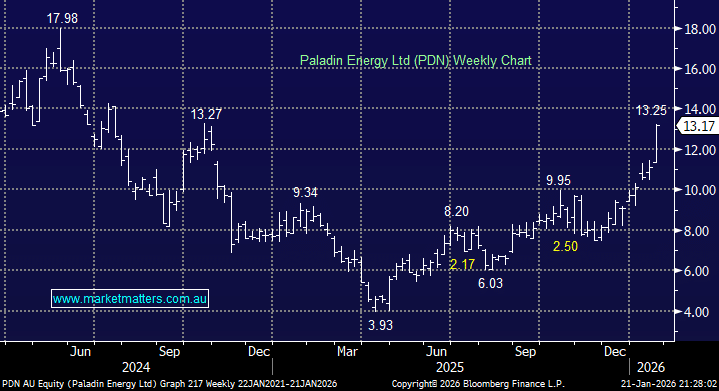

The update was enough to power its shares up by more than +13%, posting new one-year highs. The markets have been used to negative surprises from PDN, and the lack of bad news yesterday and a whopping ~12% short position were enough to catapult the stock higher. The 2Q numbers smashed some analyst expectations:

- Uranium production of 1.23 million lbs was up +15% QoQ.

- Uranium sales 1.43 million lbs vs 533,789 QoQ.

To put the numbers into perspective output exceeded Morgan Stanley’s estimate by 22% while sales beat by 19%, leaving plenty of room for upside risks to consensus estimates. Expect upgrades.

PDN is expected to return to profitability in FY26 if uranium prices remain around current levels and planned production ramps proceed as forecast. If uranium prices stay elevated or rise further and production targets are met without major delays, profitability will strengthen into FY27 and beyond. PDN’s current $5.9bn market cap isn’t onerous if these forecasts prove on point.

- We believe that PDN can test its 2024 high through 2026/7, around +40% higher: MM owns Paladin in its Active Growth Portfolio.