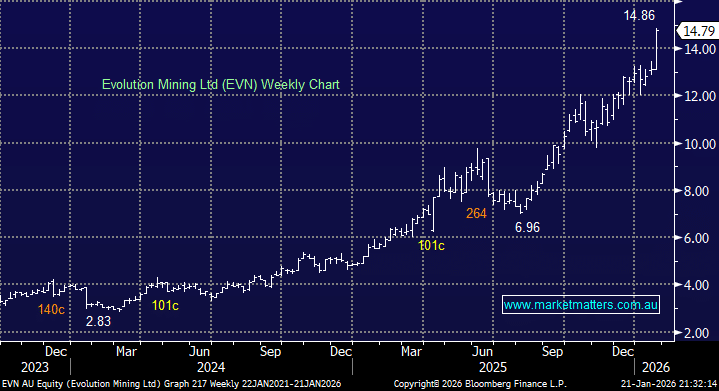

EVN shares popped +9.5% to an all-time high on Wednesday after the gold/copper producer cut its all-in sustaining cost (AISC) forecast for the full year by ~5.5% to $A1640-1760 due to stronger volumes, not bad with the precious metal surging above $A7,200 on Wednesday. This is a company kicking goals operating in a hot sector, a great combination for shareholders. Its second-quarter results looked great:

- Gold Production of 191,000 oz was up +9.8% QoQ.

- All-in sustaining costs (AISC) $A1,275.

- Copper production 17,858 tons, -0.8% QoQ.

This result was all about gold, with higher production (and by-product credits) reducing units costs – with guidance a ~5.5% beat. Group copper guidance is expected to be toward the lower end of guidance, but the market looked straight through this given the impressive run rate in gold. The esteemed analyst community have got this one very wrong with 8 Sells, 8 Holds, and just 3 Buys – and consensus price target ~20% below current prices.

- We love EVN as a company – have owned it multiple times in the past, but the risk/reward only looks attractive into the next $2 pullback – we had two last year!