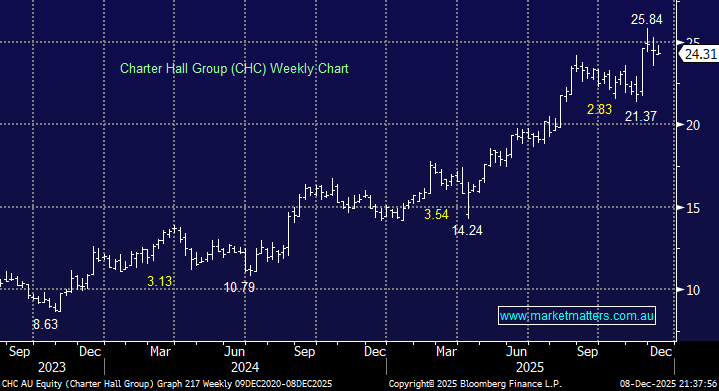

CHC has been a stellar performer over the last few years and yesterday’s dividend update did little to dent the markets current love for the stock – its noticeably outperformed the sector even as bond yields have risen. They announced an increased half-year distribution of 24.83 cents, 85% franked, putting the stock on an estimated yield of 2.1% over the next 12-months. The company already upgraded guidance by ~5.5% in November, which saw the stock pop over +15%. This is a company whose share price reflects how well they are executing.

CHC makes its money differently from most property groups; it is primarily a funds management business, not a traditional REIT. Its model is a capital-light, fee-heavy structure that has been good for shareholders. Charter Hall is less directly sensitive to interest rates than traditional REITs because it carries limited debt, but higher rates indirectly affect it through lower property valuations, reduced deal flow, slower development activity, and weaker institutional capital deployment. Hence, its muted pullback over recent weeks makes sense. We are a fan of this business, but its valuation is a concern, trading ~40% above its average over the last 5-years.

- We like CHC back around the $22 level, which does feel a long way at the moment.