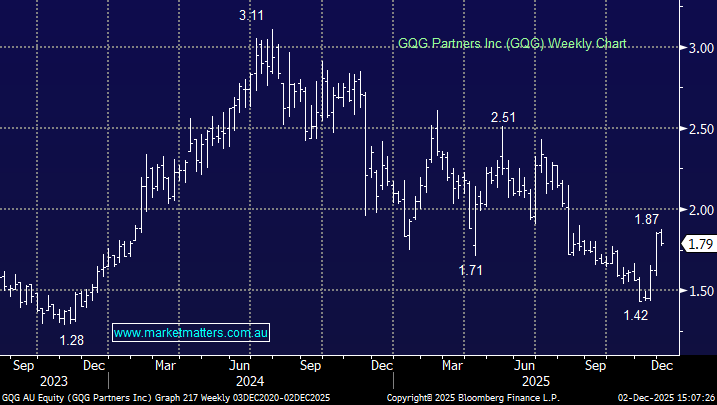

GQG has had a year to forget, down more than 50% from its 2024 high. While we haven’t held the full extent of the unwind, we did buy it on the 8th August at $1.75, and the position quickly went south, trading as low as $1.42 by mid-November. It’s recovered since, and today we’ll outline why GQG is a stock that’s still going cheap, and why we think it’s a buy at current levels, for income, with some growth potential over the medium term.

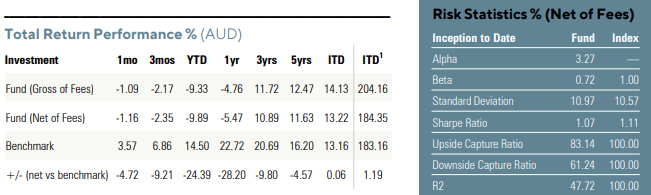

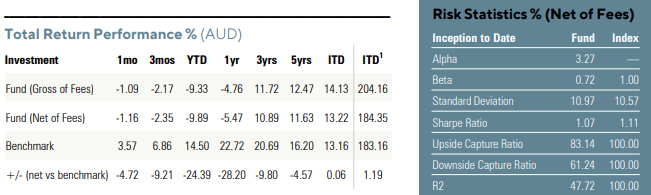

GQG manages over US$167bn and is expected to generate net profit after tax of US$464m in FY25 (December year-end). It has net cash of US$117m on the balance sheet, all wrapped up in a A$5.3bn market cap. It trades on 7.4x FY25 estimated earnings and based on consensus broker forecasts, is set to yield 12.4%. On these numbers alone, it almost sounds too good to be true – but there is a catch: recent portfolio performance stinks, as the numbers below highlight.

Three-year performance is the key metric for fund flows, and on this measure, GQG’s 10.89% p.a. after-fee return is 9.8% p.a. below the benchmark for its flagship global equities strategy. While longer-term numbers look better, and inception-to-date returns remain slightly ahead of the benchmark, the team clearly has work to do.

The underperformance stems from portfolio positioning. They’ve more recently pushed back against big tech, calling it a bubble, and opted for a more defensive stance. While this has hurt returns, we applaud their conviction and willingness to back their research. That said, as is often the case in funds management, we think there’s an element of hubris. Fund managers often believe they “know”, when in reality we operate in an inherently uncertain environment. While at Market Matters, we publish daily notes discussing our market views and positioning, and run a suite of portfolios, we live by the motto: know you don’t know. We’re never so convinced in a single view that we won’t hold uncorrelated positions.

Experience also tells us that performance can turn quickly. We are big believers in sticking with a strategy, recognising that all active managers will go through periods of relative underperformance. Underperformance usually triggers redemptions, and we are seeing increasing outflows from GQG funds. However, these remain far from alarming and have a negligible impact on earnings at this point. The risk to our thesis revolves around the prospect of sustained (and bigger) redemptions, which was certainly the case with Magellan during its tumultuous period. But GQG is not Magellan, Rajiv Jain (CIO) at GQG is not Hamish Douglas. While Hamish was a great orator, we think Rajiv is a very sound and analytical investor, with a proven long-term track record through multiple investment cycles.

- While numbers are important when assessing a stock, fund management businesses are ultimately about people and processes. As simplistic – and perhaps alarming – as it sounds, Dennis Denuto put it best this week in a replay of the best movie ever made – The Castle – “it’s the vibe”.

We get the vibe that GQG’s performance issues will turn around, particularly if the market shifts into a more risk-off mode, favouring defensive positioning. We think GQG will perform especially well in an environment where markets wobble, or if the rally broadens beyond tech. Even if tech continues to lead, GQG has strong valuation support, and absent any significant uptick in redemptions, the dividend yield above 10% looks sustainable.

- Ultimately, we see GQG as a deep-value turnaround story for 2026, with the added advantage of a defensive tilt, with a cracking yield.