- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

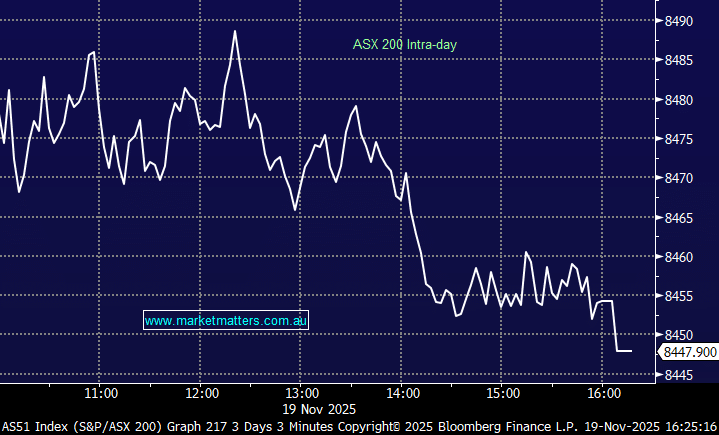

The local market spent the morning stabilising after yesterday’s selloff, with Nvidia’s earnings result tomorrow morning remaining in the focus. Strength across energy, gold and defensive names helped the market keep its head above water for most of the session, until softness prevailed into the close as investors took risk off the table with a volatile session likely in store for tomorrow.

- The ASX200 fell -21pts/-0.25% to close at 8447.

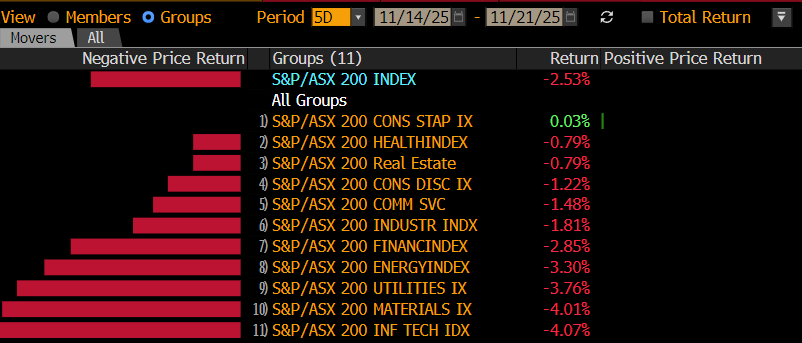

- Energy (+0.86%), Materials (+0.67%) and Real Estate (+0.63%) provided some much-needed support.

- Financials (-1.19%), Utilities (-0.52%) and IT (-0.5%) dragged the local bourse lower.

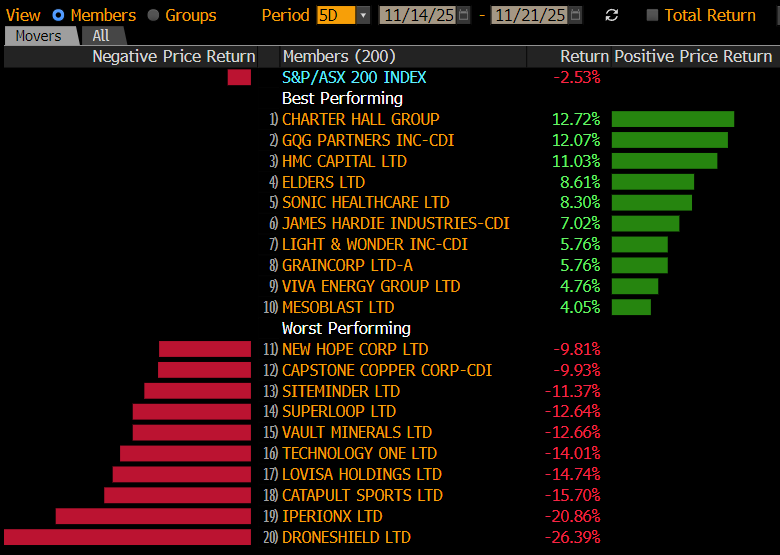

- DroneShield (DRO) -19.6% tumbled after its US CEO Matt McCrann resigned effective immediately, extending a month-long slide with the stock down 45%.

- Webjet (WJL) +16.5% surged after Helloworld (HLO) +1.7% launched a 90¢ per share takeover bid, having accumulated a ~17% stake in the business over the past few months.

- Nufarm (NUF) +10.7% jumped on their FY25 result, announcing strong but moderating growth in their crop protection segment, and announcing in-house successor Rico Christensen as new CEO after 10 years with Greg Hunt at the helm.

- TPG Telecom (TPG) -1.8% slipped after completing a $300m capital raise, reduced in size from $550m, following the Triple Zero incident linked to an outdated Samsung handset.

- Seek (SEK) +0.7% held their AGM today, with job ad volumes in line, reaffirming FY26 profit guidance and announcing CAR Group (CAR) +1.6% founder Greg Roebuck will replace Graham Goldsmith as chairman next year.

- Vulcan Energy (VUL) -9.2% was weaker on drilling results from its Lionheart Project, lithium grades and reservoir quality meeting management expectations but not the market’s.

- KMD Brands (KMD) +2.1% climbed on +7.9% first-quarter sales growth, driven by improving performance across Kathmandu, Rip Curl and Oboz.

- Asian markets were mixed, with Hong Kong -0.6% and China down 0.2%, while Japan was +0.5% higher.

- Gold traded up +$US26/oz during the session to $4091/oz around the close.

- Iron Ore in Singapore traded up +0.2%, now trading $104.60/mt at our close.

- US futures are down –0.1%.

- Nvidia (NVDA US) reports tonight in the US – we covered expectations for the result here