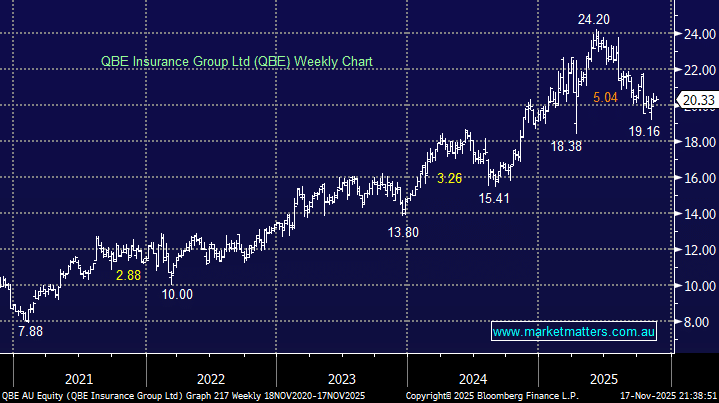

QBE’s FY25 result prompted some minor earnings downgrades, but we saw nothing concerning in the release. The company lifted its dividend after reporting a 27% increase in profit, yet following strong gains in recent years, the result was enough to trigger profit-taking, a phenomenon we’ve seen across the market in the last few weeks. On 10.2x earnings, QBE is trading around its historical average and remains well below local peers, making it increasingly compelling in our view, given the simplification within the business over recent years. In addition, the stock’s 5% part-franked dividend yield offers reasonable compensation for patient investors who share our view that QBE is entering an “accumulate” zone.

This is one business that should benefit from a less aggressive path of rate cuts by central banks, which is what officials are currently suggesting is likely through 2026. The risk/reward is looking attractive after its 20% pullback from recent June highs.

- We are likely to add QBE to our Hitlist into weakness below $20, with buybacks as an additional potential tailwind moving forward.