Private Credit

Private Credit

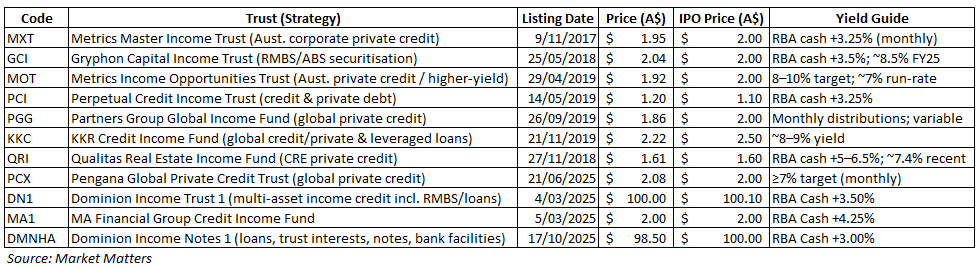

James recently wrote a column for The Australian discussing private credit in which he opined that investing in this form of lending was highly risky. The example provided (from USA) equated the security as being equivalent to junk bonds. Could you please provide a more nuanced review focusing on offerings in Australia, perhaps even offering some suggestions where you view the risk vis a vis other higher return investments such as hybrids. Some managers such as Avari, Woodbridge and MaxCap offer private credit secured by first mortgages with low LVRs which I would have thought was vastly superior to junk bond status.

Thanks Bruce Phillips

Good Morning, James & Team,

- Several commentators have mentioned that the private credit market is risky. How so? Do stocks like MXT & the like fall in the private credit category?

- Does changing the volume in an existing share order without changing the price move the order in the queue?

- Which would you consider to be a better investment, EOS OR DRO? The CEO of EOS was obviously talking up the book in a recent interview on Ausbiz .

How much weight would you ascribe to his very bullish forecasts? Many thanks & Cheers Sidney