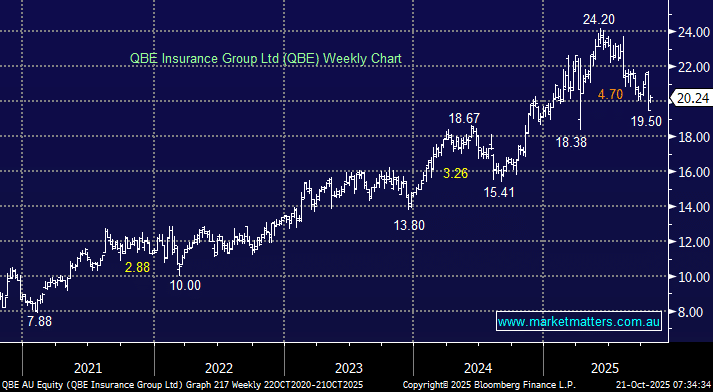

QBE has already corrected over -19% since June while the ASX200 has forged to new all-time highs, amplifying its underperformance. With ~50% of its revenue coming from North America, poor performance by US insurers and Fed rate cuts weighing on profitability, QBE has not surprisingly been under pressure of late. QBE receives income from its U.S. cash/bond investments, hence lower rates = lower income before some of the funds are used to payout claims. The US insurers fell another 2.7% overnight, with the sector washout appearing to have further to go, which is likely to weigh on QBE in the short term, but we believe their pullback is already maturing.

QBE’s FY25 result did lead to some small downgrades, but we saw nothing untoward in its result. The company lifted its dividend as profit jumped by +27% but after advancing strongly in recent years, it was enough to see profit taking drag the stock lower. QBE is trading on 10.1x, having come back to its historical average, and well below its local peers – it is starting to looking interesting in our opinion. Also, the stocks 5% part-franked yield gives some return to patient investors who agree with us that QBE is in an “accumulate” zone. With QBE being tarred with the same brush as its US peers we can see upside surprises moving forward.

- We like the risk/reward towards QBE below $20, although we’re conscious that negative sentiment toward the sector may persist a little further.