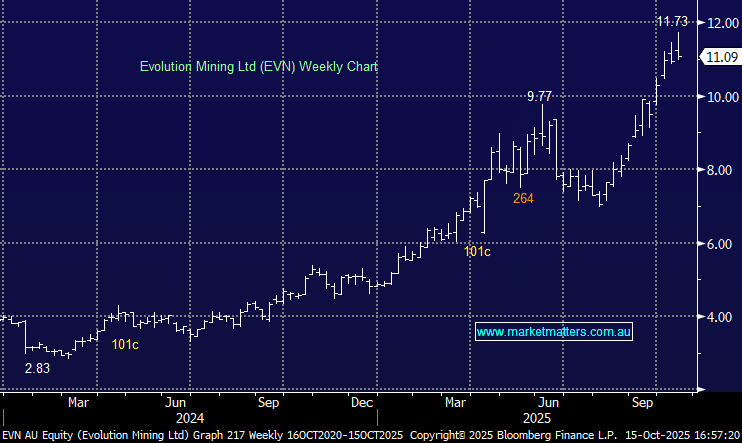

EVN –2.89%: Reported a steady first quarter, with output slightly softer across most assets – Cowal (-5.3%), Ernest Henry (-5.6%), and Red Lake (-6.3%) – though this was partly offset by Mungari (+2.6%), which continues to perform well.

- Gold production of 174,000oz, down 4.4% quarter-on-quarter

- All-In-Sustaining-Cost of A$1,724, in line with consensus

- Copper production of 18,000 tonnes (-5.3% q/q)

The company remains on track to meet FY26 production and cost guidance. Importantly, the Mungari mill expansion is now complete, coming in 15% under budget at A$212m, with commercial production expected in October.

A clean if unremarkable start to FY26 for Evolution, with production in line and costs under control. With two U.S rate cuts now looking likely after Fed Chair Jerome Powell’s comments overnight, bullion looks set to move higher, though we wouldn’t be surprised if gold equities cooled off in the short-term.