Hi Mark,

For subscribers not familiar with MMI it’s a $555mn Australian company that produces and exports bauxite from its Bauxite Hills Mine in Cape York, Queensland, primarily supplying Asian markets. Its operations focus on low-cost, direct shipping ore (DSO) with seasonal mining and marine-based transshipment logistics.

The company delivered a significant turnaround in 1H of FY25:

- Revenue of $145mn was up +78% YoY, with the FY estimated to reach $432mn.

- Over the half they also delivered NPAT of $119.8mn, following a loss in the previous year.

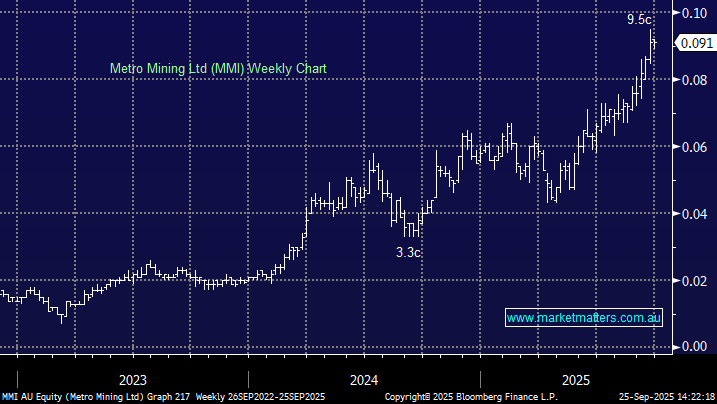

At the end of June 2025, Metro Mining reported a net debt of approximately $44mn, down from $75.2mn in December 2024. The stock has tripled accordingly, over the last 12-months, but while it’s clearly a “specie” we still think it looks good value ~9c. Harry (who was with MM for a long time / now overseas) is a big believer in MMI!