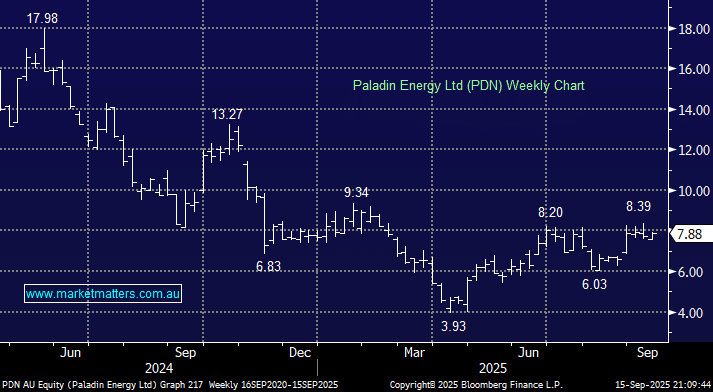

Uranium miner Paladin Energy (PDN) has gone cap in hand to the market overnight, although not a huge raise for the $3.1bn miner. Macquarie Capital were approaching fund managers for the $300mn equity injection for PDN on Monday evening. The “word on the street” is that Paladin was hoping to secure about $300 million in fresh equity; if they place more, it will imply strong demand. This morning the miner has confirmed a $231 institutional placement, $33m from Canada and $36m from a treasury share sale, totalling $300m (pre-costs), all done at $7.25 – an 8% discount to last. There will be an SPP open for retail investors for another $20m.

NB: For those not familiar with a treasury sale, it’s when a company raises equity by selling shares that it already issued in the past but later repurchased and held in its treasury (rather than cancelling them).

A ~10% gain by US uranium giant Cameco (CCJ US), and a strong night for its peers, after the US Energy Secretary said the US is looking to boost its national strategic uranium stockpile, should help sentiment towards the local uranium sector this morning.

- PDN will probably trade down initially today, however the raise is fairly small, the capital is being used to accelerate growth at the Patterson Lake South project and Uranium stocks roared higher overnight – any dip here (if it prevails) would be a buying opportunity: MM holds PDN in the Active Growth and Emerging Companies Portfolios.