The rise of DroneShield has led it become one of the most discussed stocks in our Q&A Weekend Report. DRO is an Australian defence technology company that develops AI-powered systems to detect, track, and neutralize hostile drones for military, government, and critical infrastructure clients worldwide. In todays unstable geopolitical world DRO has flourished as defence budgets surge, especially in response to the Ukraine and Middle East conflicts. NATO countries collectively spent $US1.5 trillion in 2024, with Europe contributing significantly while world military expenditure reached a whopping ~ $US2.7 trillion, marking the fastest year-on-year jump since the Cold War.

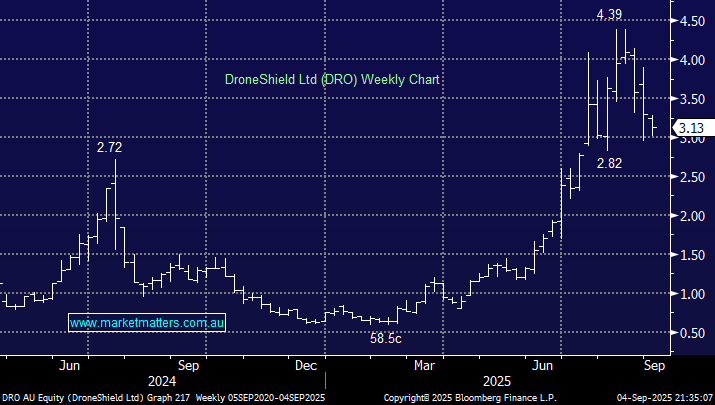

With governments spending more, companies at the forefront of their respective technologies/fields have flourished with big tenders out there to be won. The surge by DRO has pushed its market cap to $2.7bn, as they continue to string together contract wins with influential customers, the company’s achieved FY25 contracted revenue above $175mn at the start of August, already 3x that recorded in FY24. Unfortunately global stability feels unlikely in the coming years leaving DRO well positioned, but it’s expensive and subsequently volatile – the last few weeks have seen the stock correct well over 30%.

- We like DRO from a risk/reward perspective into current weakness around $3.