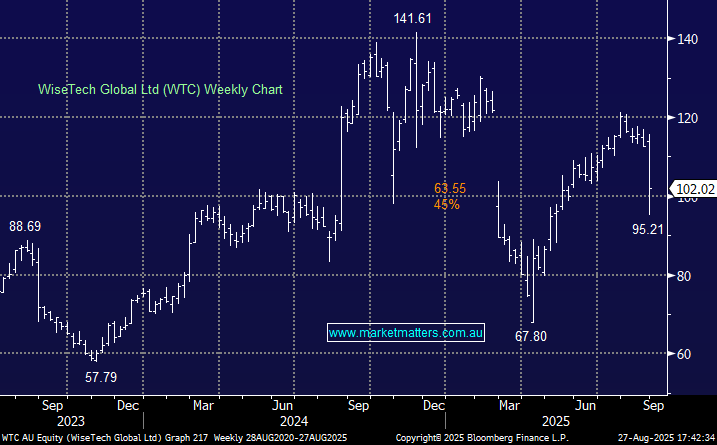

WTC -11.86%: fell as much as 18% after FY25 revenue missed expectations and FY26 guidance flagged margin pressure from its e2open acquisition.

- Revenue US$778.7 million (+14% y/y), short of consensus US$796.9 million.

- EBITDA US$381.6 million (+17% y/y), slightly ahead of consensus; excluding acquisition costs.

- Final dividend 7.7 cents per share.

A rebound in the stock following sharp selloffs has become familiar over the past 12 months so we are comfortable with our position and will wait to see new CEO Zubin Appoo and a renewed Richard White have more time to make an impact before we change our view.

- Distractions are subsiding, the business should be hitting its stride by FY26-end.