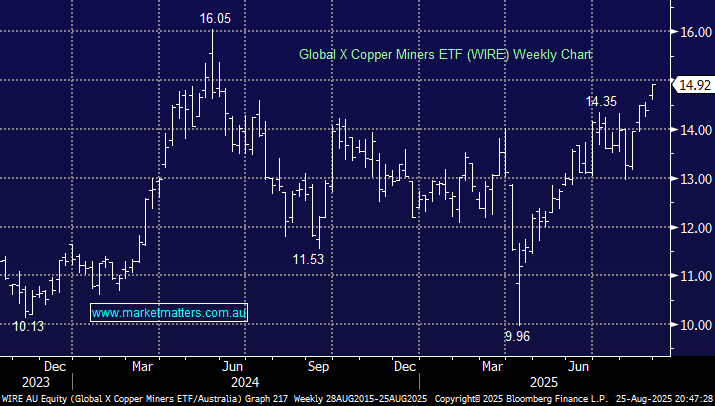

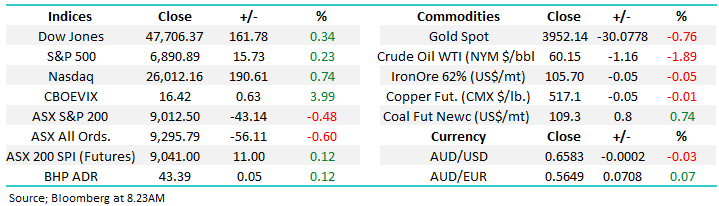

Copper has been a fascinating topic on its own through 2025 as President Trump toyed with the market around tariffs on the industrial metal sending the US Comex price soaring and then plunging over just a few months. However, the ASX miners sell most of the Cu on the UK London Metal Exchange (LME) hence they’ve been far more orderly. The Global X Copper Miners ETF (WIRE), which is traded on the ASX, holds 37% in Canadian Cu miners, 10% China, and 9% in US miners, while Australian names only make up around 13% of the ETF, giving excellent global coverage to the sector.

- We remain bullish on Cu in the years ahead, making the WIRE ETF an excellent proxy for exposure to global electrification.

Moving closer to home, ASX copper names have experienced a mixed 2025, with heavyweight Sandfire (SFR) charging to new highs while the more junior names have been left in its wake. This is another example of fund managers concentrating their bets in theoretically the biggest and best companies. In the short term, SFR has disconnected from the Cu price, bringing with it a degree of risk as its valuation stretches in an increasingly crowded position, especially compared to its peers. We see a few obvious reasons for this disconnect:

- Since BHP took over OZ Minerals, SFR has become the go-to pure Cu play on the ASX.

- The market, like ourselves, is bullish towards Cu over the years ahead, as AI, global electrification and EV adoption gather momentum.

- SFR received some downgrades early in the year on valuation grounds. Goldman lowered its rating to neutral and PT to $9.60 in April.

- It feels like CBA all over again as the non-believers get squeezed and begrudging upgrades may follow.

From our perspective, it’s a matter of how to position for higher Cu prices rather than whether to.

- We are becoming increasingly conscious that SFR is getting stretched on the upside, though we are bullish in the longer term.