New Zealand dairy brand A2 Milk (A2M) has surged ~34% over the past six months, riding a bullish re-rating earlier this year after a standout result, with revenue beating expectations by 10%. Around 67% of FY24 revenue came from China, so all eyes will be on the performance of its second China Label (CL) product when results drop next Monday (18th). The stock’s 2025 rally has been powered by both earnings growth and a higher earnings multiple — a combination that can cut both ways if expectations aren’t met.

Looking ahead, forecasting A2M remains tricky, but 2026 should see its China business keep expanding despite a softer overall infant formula market. The company’s premium positioning resonates with health-conscious parents, and a strong pipeline of new products is helping to drive sales. Growth may be slower than in the boom years, but A2M is still on track to outpace most rivals — with China firmly at the heart of its success.

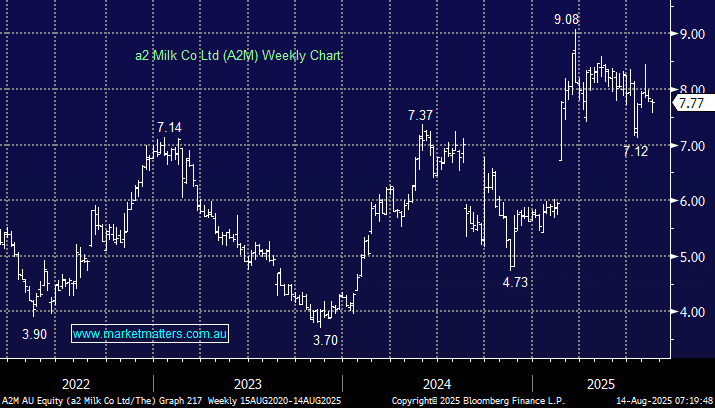

- We can see A2M making new highs into Christmas, but it’s not for the fainthearted.