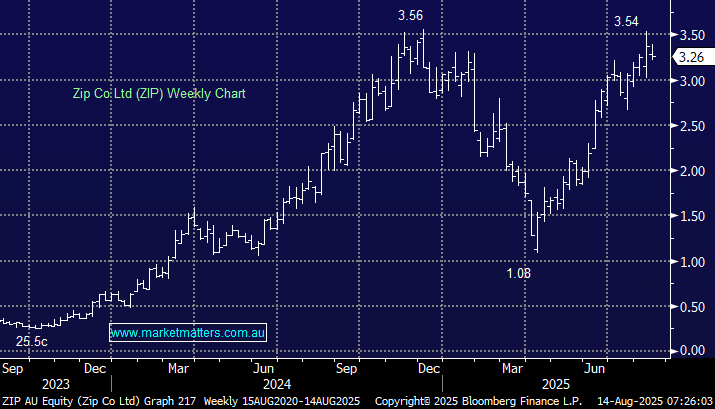

We bought ZIP in May and we’re already up over 60% illustrating the recent strength in the BNPL company – ZIP reports on the 22nd. We continue to like the growth in their US business, with Total Transaction Value (TTV) and revenue increasing over 40% a piece, year-on-year. We bought the stock for growth in its US operations, which already makes up over 50% of its revenue and this is where the market’s focus will be next week. They have been executing extremely well and we have no reason to doubt they will continue to do so into 2026.

Zip is expanding their Google Pay collaboration offering innovative people-centred products. Now, US shoppers can select Zip’s payment options directly through Chrome’s autofill feature, allowing them to split purchases into equal instalments without switching apps, or re-entering payment details which makes it far more accessible, with a broader reach and a faster, safer, more empowering checkout experience. We are also encouraged by US-listed Sezzle’s recent trading update, where they saw no deterioration in consumer credit while they maintained growth in the June quarter.

Also, we saw some added spice enter the sector this week, with $630mn Tyro Payments (TYR) confirming it had received takeover interest from multiple parties. This is a very different proposition from $4.2bn ZIP, but it does signal that the payments space is enjoying a fresh lease on life.

- We can see ZIP breaking out to new 2025 highs in the coming weeks/months: We hold ZIP in our Emerging Companies Portfolio.