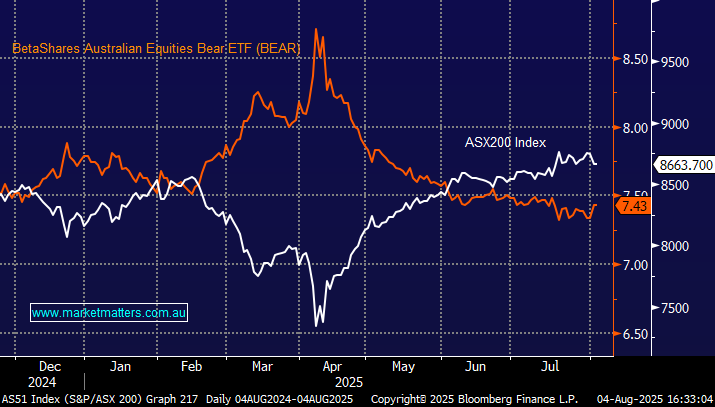

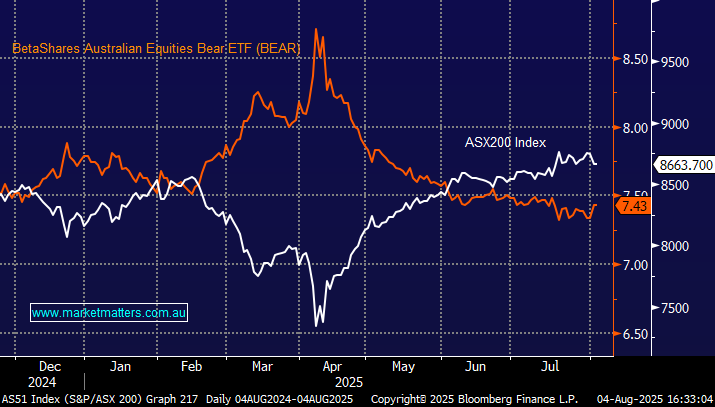

The objective of the BEAR ETF is to allow investors to profit from a declining ASX200 with no leverage. However, like most bearish ETFs, it’s relatively expensive, costing 1.38% pa. During the panic selloff, primarily in April, the ASX200 fell 16.9% while the BEAR ETF surged +18.5%, a reasonably good correlation in a fast-moving panic-like market. However, the issue today is that such declines are rare, with this year’s move the largest correction since the COVID pandemic.

- We can see the ASX200 retreating ~3% but such a move will hardly register on the BEAR ETF.