The world’s largest online retailer delivered some big numbers as it beat 1Q estimates, but this side of the business is feeling at the mercy of the consumer who is still battling. AMZN is playing the role of a “seller of shovels” in the AI gold rush: building and monetising the underlying platform rather than directly competing in consumer-facing AI, a position that should come with less upside but much less risk than the all-in approach of say META.

Amazon Web Services (AWS) provides on-demand technology services to individuals, companies, and governments, including everything from storage and computing power to AI tools and databases. 1Q revenue reached $US29.3 billion, contributing ~19% of Amazon’s total revenue and accounting for over 60% of operating profit. The evolution of AWS isn’t cheap, with Amazon intending to spend $US100–105 billion on CAPEX in FY25, with the vast majority funnelled into AWS and AI projects but, they are already reaping rewards.

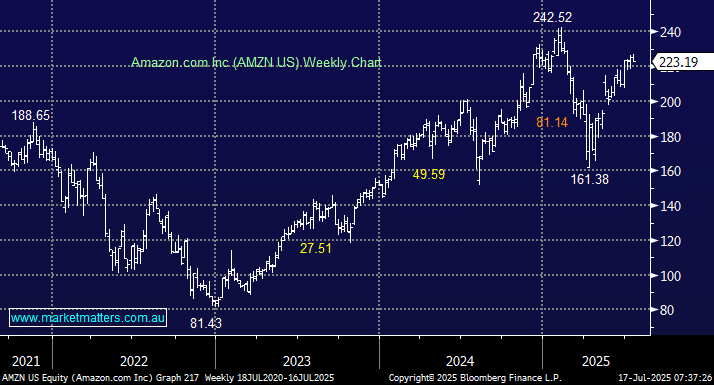

- We like AMZN targeting new highs, around 8-10% higher, into Christmas.