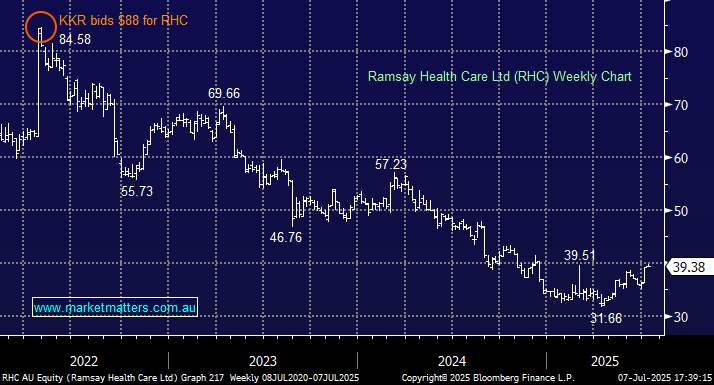

Private hospital operator RHC is on the MM Hitlist after we reviewed the stock in detail earlier this month. Our back-of-the-envelope calculations, plus the markets overall dislike of its investment in Ramsay Sante, could see a 10-15% bullish rerating if/when they exit their holding; they are currently exploring strategies. However, the stock has rallied over the last month on P/E expansion over recent weeks as opposed to earnings upgrades, as the divestment slowly gets factored into the share price. The potential for higher wage costs for RHC moving forward is also a concern, and we aren’t keen to chase the stock up towards $40.

- We like RHC, but the risk/reward has fallen after its recent strong gains.