COL has well and truly trumped WOW over the last few years, with its stock up almost 50% from its late 2023 low while WOW has slid ~20%. Not surprisingly having executed far better from an operational perspective than WOW in the last few years, COL is trading slightly above its historical average valuation but like most “defensive” stocks it’s not significantly rich compared to many on the ASX. The numbers tell the tale as always: COL reported a 4.3% increase in supermarket sales for the December half of 2024, whereas WOW only notched a 2.7% gain. However, COL is still trading on an estimated 26.5x FY25 valuation compared to 28.2x for WOW, which appears skewed the wrong way on the surface, but like us, the market is looking for WOW to address some of its recent underperformance.

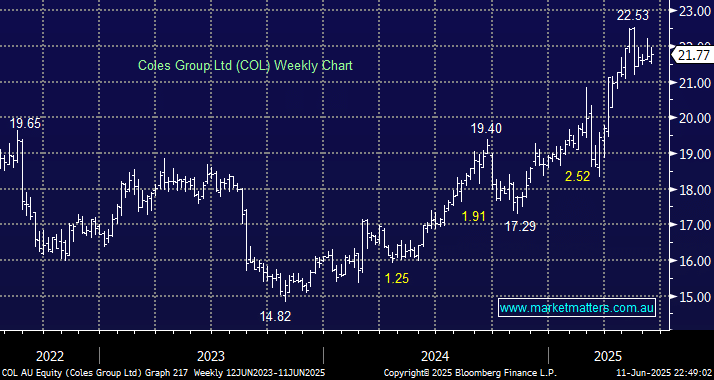

- We can see COL testing above $23 into Christmas.