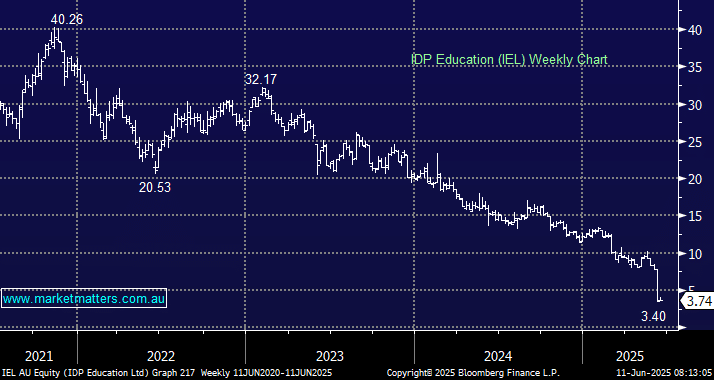

It’s been a torrid week or so for IDP Education downgrading earnings forecasts as a result of falling testing volumes, amid continued uncertainty around global immigration and trade policy. This led to a 30% reduction in FY25 underlying earnings guidance (Ebit), with the company now expecting $115-$125 million vs consensus at ~$165 million – the stock plunged ~50%. Having traded above $17 in August 2024, sub $4 looks interesting to MM, assuming the model is not broken.

The decline in share price over the past 10 months seems extreme for the reduction in earnings, with Ebit for 2025 expected to be $120m at the midpoint of new guidance versus $240m in 2024. That said, they have downgraded at each of the last two earnings updates, which implies that management do not have a good handle on the business, partially understandable given the significant changes in the macro-economic environment. While this has clearly knocked IEL for six, it would stand to reason that more certainty in the macro, would afford them more certainty at the company level.

- With the stock price less than ¼ the price it was trading in August 2024, we pose the obvious question: Is there value here?

There are now very low expectations priced into the stock for both FY25 and FY26, and while we appreciate that uncertainty remains around the policy cycle, in our view it feels like the current operating environment is close to trough conditions. Importantly, we do not believe the business model is broken; it’s just been hit by short-term factors. They announced a cost reduction program, which will help, but any earnings recovery will take time, and the market will take some convincing before jumping back on the bandwagon of this previous market darling

- While we’re in no hurry here, we view a price below $4 as an interesting opportunity for those with a medium-term horizon, i.e. over the next 2-3 years, to buy a quality business, hit by short-term headwinds.