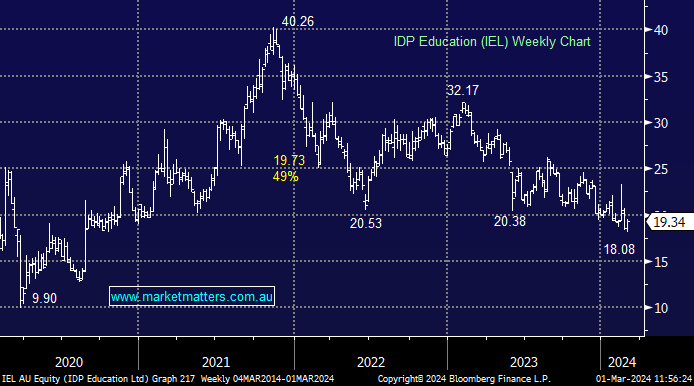

Is IDP Education Ltd (IEL) cheap?

Dear James, Shawn, and the MM team, IEL (IDP Education) Share Price has fallen from $23.33 when it first announced 1H FY24 Results on (14/2) to $18.91 as of today (29/2) - a drop of 19%, despite a solid result with Rev up 15%, & EBIT up 25%. This is mainly due to migration policies and competitive landscape. I feel this is overdone. It’s felt these factors have already been priced in before the result announcement. The strong 1H results showed positives that will continue to drive long-term growth, such as fee increases, Student Placement market share gains. Thanks again for taking this question.