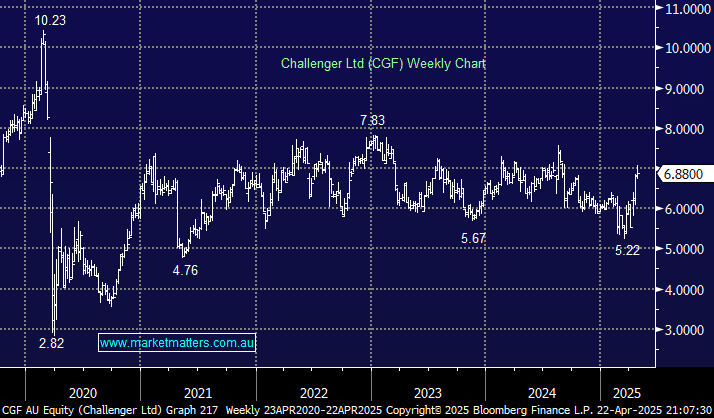

CGF was a market darling about eight years ago, but as so often happens, when too many people become bullish, the wheels can fall off. In the case of CGF, this was dramatic, with the stock falling 80% in less than three years. However, CGF has steadied the ship over recent years, and yesterday’s +1.2% advance took the stock to levels not seen since last September. The news flow from CGF has been positive over the last few weeks, leading us to question whether the investment manager is set to be re-rated on the upside. Last week’s 3rd quarter update was very well received, with Total Life sales of $ 1.4 billion supported by longer tenor annuity sales:

- Retail lifetime annuity sales were $246 million, up +22%, Japanese sales of $240 million were up +33%, and fixed term annuity sales of $505 million were up +15%.

- CGF’s funds under management are $115.2 billion, a $5.9 billion drop, mainly due to adverse market movements, net outflows of $1.9 billion, and client distributions of $0.3 billion.

We agree with the market’s positive interpretation of the update and like CGF’s sales growth profile across domestic and Japanese lifetime annuities. Upgrades have followed for CGF with 1 Hold, 8 Buys and 3 Strong Buys now on the stock with most major brokers in the $7.50-$8 range. Sentiment towards the stock has improved since MS&AD Insurance agreed to sell its 15.1% stake in CGF to TAL, a subsidiary of Dai-ichi Life Holdings, who said they recognise the evolving needs of Australia’s retirement market, and the minority investment in Challenger reflects TAL’s long-term commitment to the retirement income solutions sector – all sounds positive, and they paid a whopping $8.46 each for the shares!

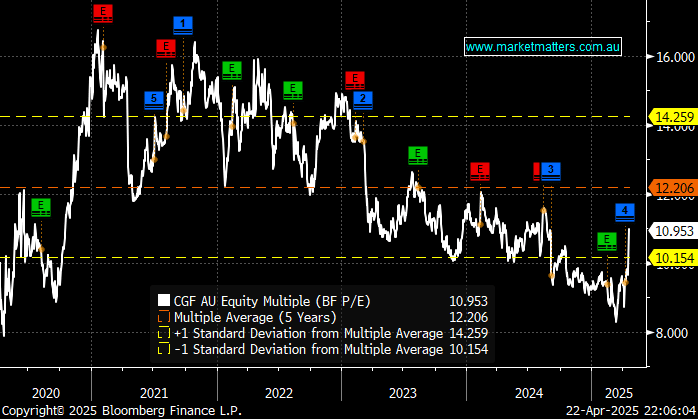

- From a valuation perspective, CGF remains ~10% below its 5-year average, but to us, if anything, it should be 10% above, as the turnaround gathers momentum.

Previously we’ve been consistently cautious on CGF given the complexity in their book that underpins the annuity liabilities – many appeared to agree with the stock trading in the $5 and $8 band for almost 4 years. However, with strong sales and improving tenor in its book, we are now upbeat on its prospects going forward, aided by its undemanding 11.3x valuation and ~4.4% fully franked yield. CGF should have no problems maintaining/improving its sales momentum in today’s uncertain economic environment.

- We like CGF around $7 initially targeting a retest of $8.