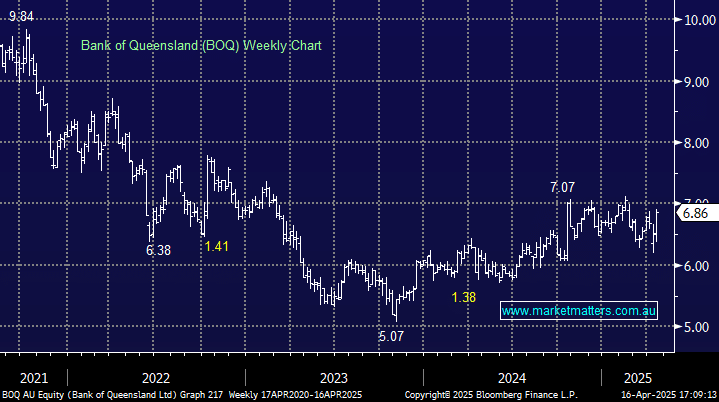

BOQ +5.54%: Reported strong 1H25 earnings this morning highlighting solid execution in reducing costs through productivity with net interest margins remaining robust.

- Cash profit $183 million, +6.4% y/y, estimate A$165.7 million

- Net interest margin on cash basis 1.57% vs. 1.55% y/y

- Interim dividend per share A$0.18 vs. A$0.17 y/y

Cash earnings grew after better margin management, improved efficiency from continued focus on digital transformation, and a reduction in credit default/losses. The Australian economy picked up during the half, with rising disposable incomes and a strong job market helping to improve BOQ customer conditions. Looking ahead, management expects headline margins to improve further in the second half of 2025, especially as their ‘branch strategy’ starts to take effect – a focus on high-quality QLD business customers. BOQ currently screens slightly richer side trading at 12.5x P/E (FY26e) vs. historical average of 11.9x. We prefer ANZ Bank (ANZ) and Westpac (WBC).