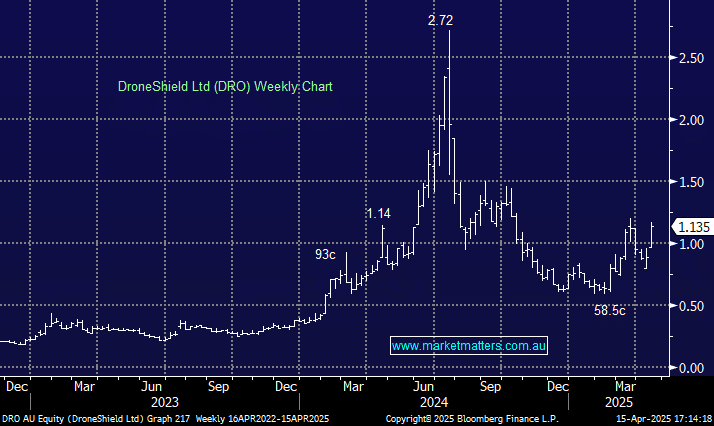

DroneShield (DRO) specialises in counter-drone and counter-uncrewed systems technologies to detect, identify, and neutralise unauthorised or hostile drones in various environments. The company’s shares have experienced a wild 15 months as investors got far too carried away with the growth of this technology stock without paying attention to valuations. A capital raise didn’t help the share price:

- In August, they raised $120mn primarily for R&D at $1.15, a ~17% discount to its last trade at the time; interestingly, the shares were trading at the same level on Tuesday.

- As the stock surged above $2 in mid-2024, the company’s market cap. rose well above $2bn, a rich price for a company whose revenue is only forecast to be ~$140mn in FY26.

The company is benefitting from growing demand in the uncertain geopolitical environment. Yesterday, DRO announced they had secured five repeat defence contracts totalling $32.2 million from an Asia Pacific military client. These repeat orders from an APAC customer illustrate a scaling up of orders after successful field trials and customer pilots. We see this as repeatable across regions and resellers as DRO scales. Topically, we do not anticipate margin compression from the 10% tariff on Australian imports into the US.

Price is not the primary driver in purchasing decisions for DRO’s customers; they prioritise technology leadership and complete counter solutions. DRO has built a record sales pipeline of $1.2B, highlighting a rising global need for counter-drone solutions as it continues to broaden its global footprint, securing notable deals such as a $9.7m contract in Latin America, an $8.2m NATO award, and $11.8m in APAC agreements (prior to yesterday’s announcement). The company is also well placed to benefit from increased defence expenditure under NATO and AUKUS. DRO has already secured approximately ~$90m in revenue for CY25, with 8 months remaining, indicating solid earnings potential. Hence, although trading on an 81x valuation for FY25, the revenue growth and returning customers are a healthy roadmap moving forward.

- We like DRO over the coming months, initially targeting the $1.40 area, or ~25% higher: We have added DRO to our Hitlist.