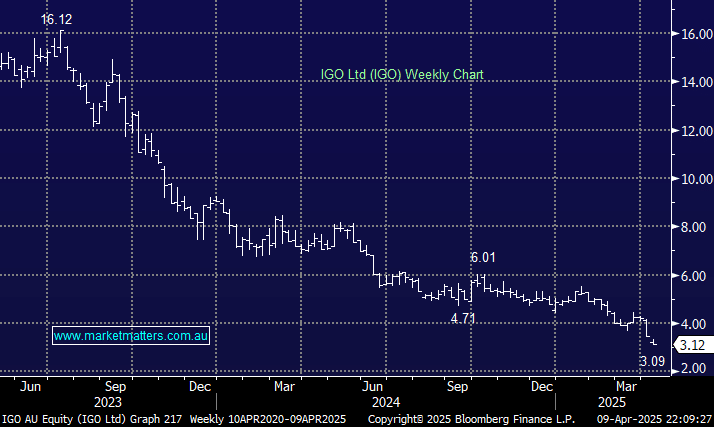

Lithium/nickel miner IGO is doing everything it can to get things right. FY25 production is tracking to the top end of guidance, while costs are to the lower end, a rare and pleasant combination. However, like all miners, this is a cyclical play, and lithium prices need to rally before IGO’s earnings profile becomes exciting. IGO has made plenty of mistakes in recent years, leading to its painful rerating, but we need more than a one-day bounce to regain confidence in Nickel and Li.

- We can see IGO back above $4 in the coming weeks/months, but it’s not on our radar.