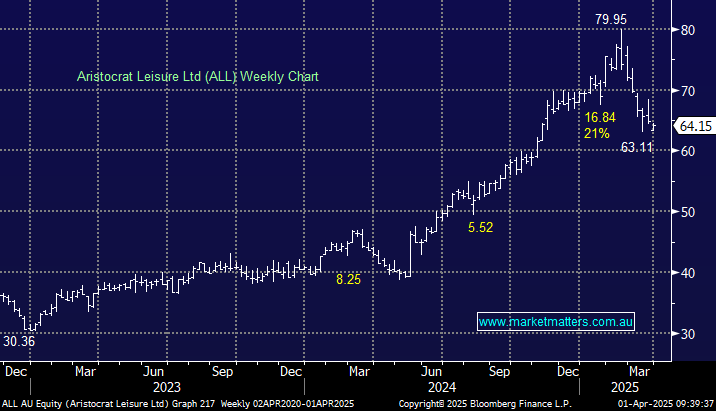

We are using the ~20% pullback in Aristocrat Leisure (ALL) to add the stock in to the Active Growth Portfolio. Buying quality growth into market weakness remains our preferred approach.

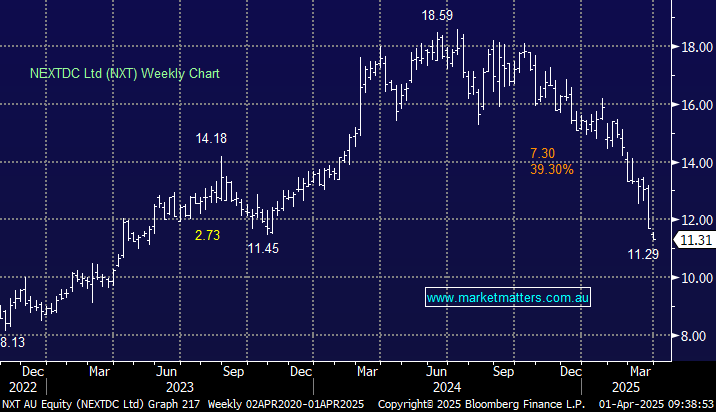

The wind has come out of the data centre sail and we are concerned that we have too large of a portfolio weighting exposed to the sector. While we think the AI thematic will be akin to the industrial revolution, there is risk around how rapidly developments are happening. For the data centre space that relies on longer lead times and committed capital, this could present some complexity. We are selling NXT to leave GMG as our data centre exposure with a broader industrial portfolio to complement it.