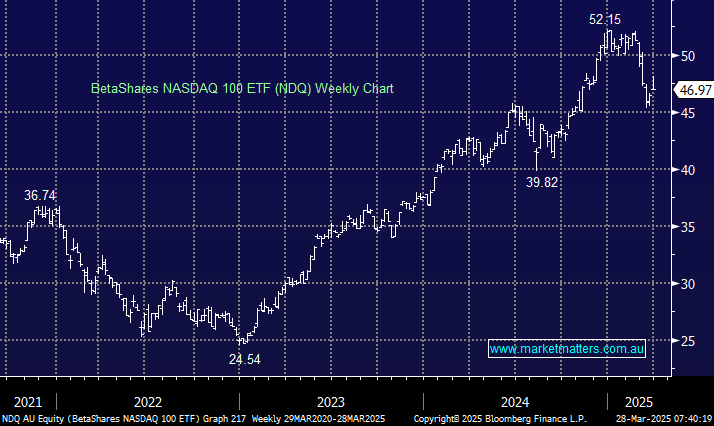

The volatility within the US Big Tech names has been tremendous in 2025 as AI fell out of favour along with Elon Musk’s Tesla. Additionally, growth stocks have experienced significant valuation compression due to concerns that tariffs will drive the global economy into recession. There are arguments both ways for and against using US tech ETFs: for is the insulation against stocks falling aggressively out of favour as has been the case for Tesla, against is the same volatility on the stock level will afford excellent opportunities for investors who can be ahead of the crowd.

- We like the NDQ into Christmas but we’re conscious that Asian tech is starting to make waves.

The ASX-traded NDQ ETF aims to track the performance of the NASDAQ 100 with its current five most significant holdings comprising Apple, Microsoft, NVIDIA, Amazon and Broadcom, which collectively make up almost 35% of the ETF. This is an excellent vehicle for gaining exposure to a diverse basket of US tech names without being too focused on 1 or 2 companies. The fees are 0.48% per annum.

- We like the NDQ ETF for at least a sharp short-term bounce after next week’s tariff news.