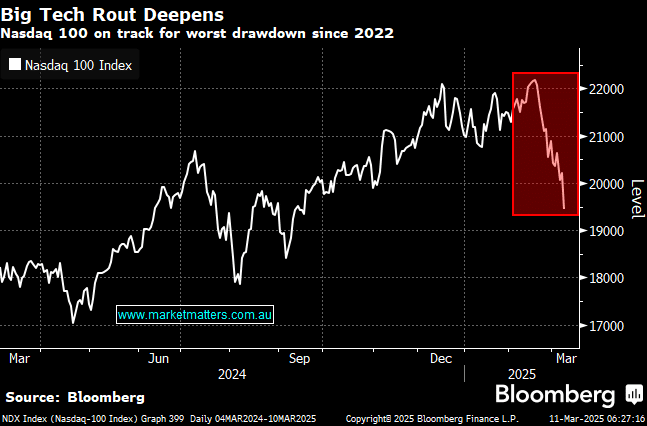

Technology shares led the biggest selloff in American stocks since 2022, as investors abandoned longtime market leaders amid growing concerns that the economy is headed for a recession. The mini ‘Tech Wreck’ followed a weekend in which Trump administration officials—and President Donald Trump himself—suggested that the American economy is set to slow. This shift in rhetoric from the campaign trail—where Trump had promised tariffs on Day One to fund tax cuts without disrupting growth—has triggered a frenzied repricing of risk assets. In recent weeks, Wall Street had been cautiously rotating out of tech and into more defensive sectors as on-again, off-again trade policies unsettled investors, while inflation remained stubbornly high. That rotation accelerated on Monday after the unsettling weekend comments on economic growth.

The selloff has been even more extreme in the speculative corners of the market. A basket of profitless technology companies has underperformed the majors, bringing its year-to-date decline to approximately 15%. The gauge is on track for its worst quarter since 2022. After being priced for perfection just a few weeks ago, the wheels have come off the crowded tech space. Except for Meta, all the Magnificent Seven stocks are down for the year, with Nvidia down double digits and Tesla shedding more than $500 billion in market value so far in 2025.

- We remain neutral toward US tech-based NASDAQ, with a test of 18,000 support looking increasingly possible, i.e. ~7% lower.